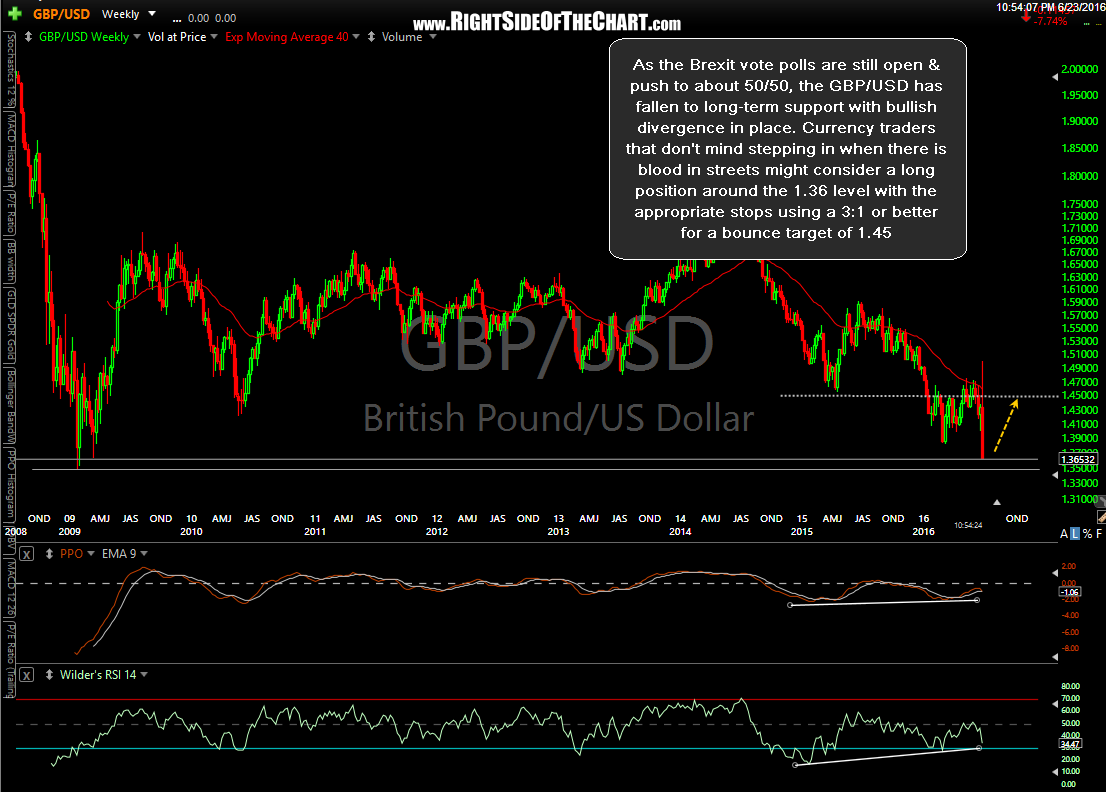

As the Brexit vote polls are still open & push to about 50/50, the GBP/USD has fallen to long-term support with bullish divergence in place. Currency traders that don’t mind stepping in when there is blood in streets might consider a long position around the 1.36 level with the appropriate stops using a 3:1 or better for a bounce target of 1.45. Unofficial trade idea. Weekly chart:

Pound Sterling at Support, Bounce Likely

Share this! (member restricted content requires registration)

7 Comments