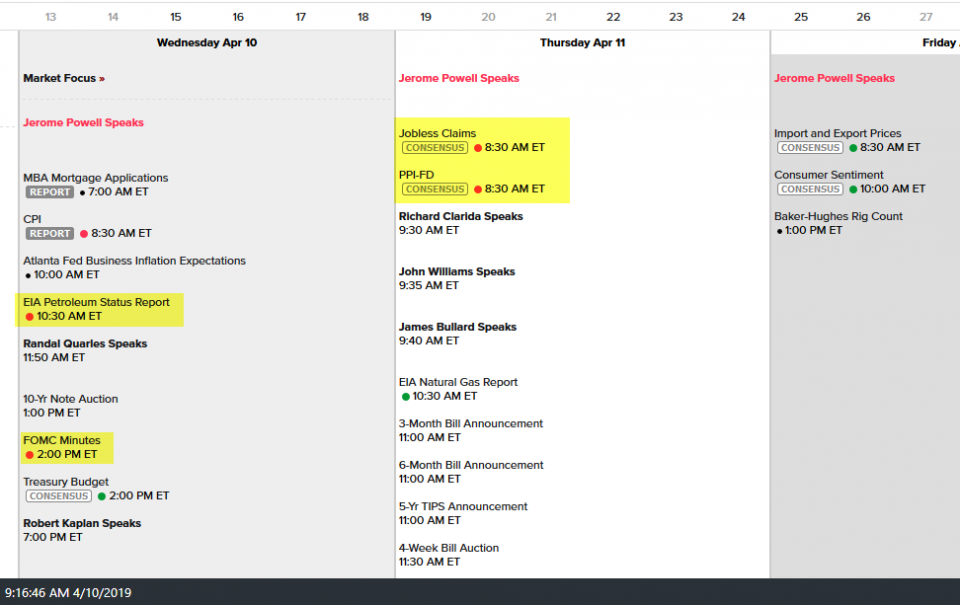

As far as the charts I’m watching, just about everything highlighted earlier this week has hardly moved over the past couple of sessions so the levels on those indexes, commodities & stocks remain the same. We do have a few potentially market-moving items on the economic calendar for the remainder of this week, starting with the CPI at 8:30 am EST today, which was followed by a couple of back & forth spikes in the futures so far but nothing technically significant.

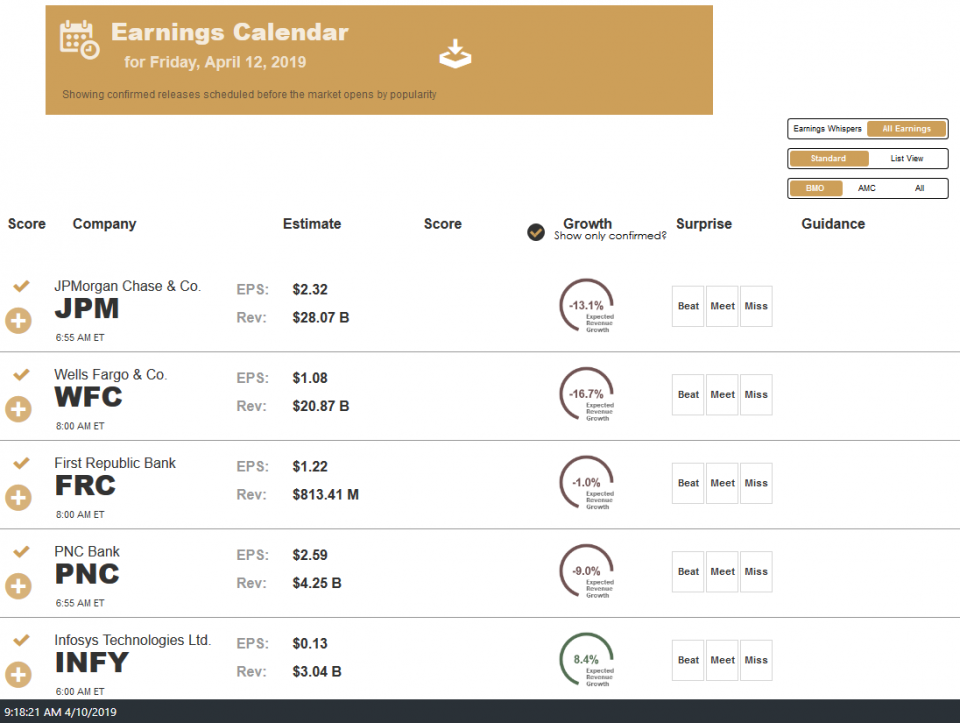

For those trading or considering a position in crude oil or the energy stocks, the EIA Petroleum Status Report is scheduled for 10:30 am today with the FOMC Minutes to be released at 2 pm. One hour before the market opens tomorrow (8:30) we have Jobless Claims & the PPI Final Demand Index. Earnings season will start to pick up next week although before then, the financials (XLF, KBE, KRE, IAT are a few ETFs) are likely to move one way or the other after a slew of big banks report before the market opens on Friday, including JPM, WFC, FRC & PNC.