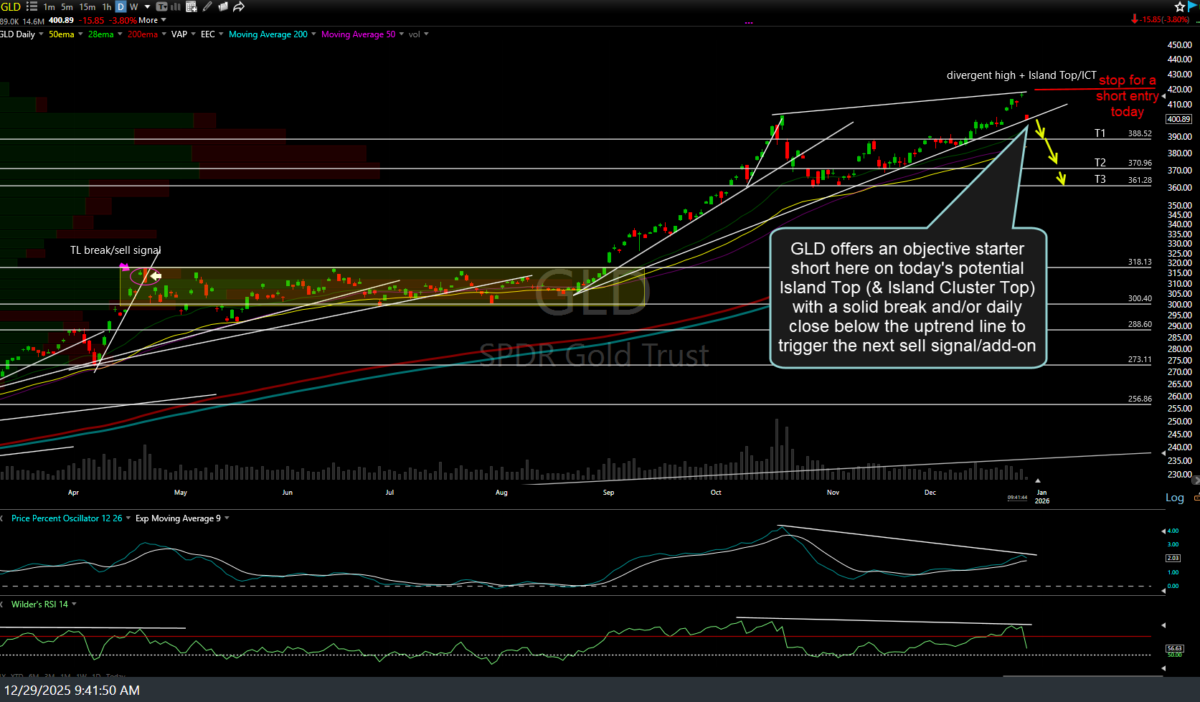

GLD (gold ETF or /GC, /MGC futures) offers an objective starter short here on today’s potential Island Top (& Island Cluster Top) with a solid break and/or daily close below the uptrend line to trigger the next sell signal/add-on. Stops for any starter short position taken on today’s potential Island Top (and Island Cluster Top) reversal pattern would be any move above Friday’s high. Should GLD go on to break down & print a solid close below the uptrend line, triggering that more significant sell signal soon, stops would be commensurate with one’s average entry price. Daily chart below.

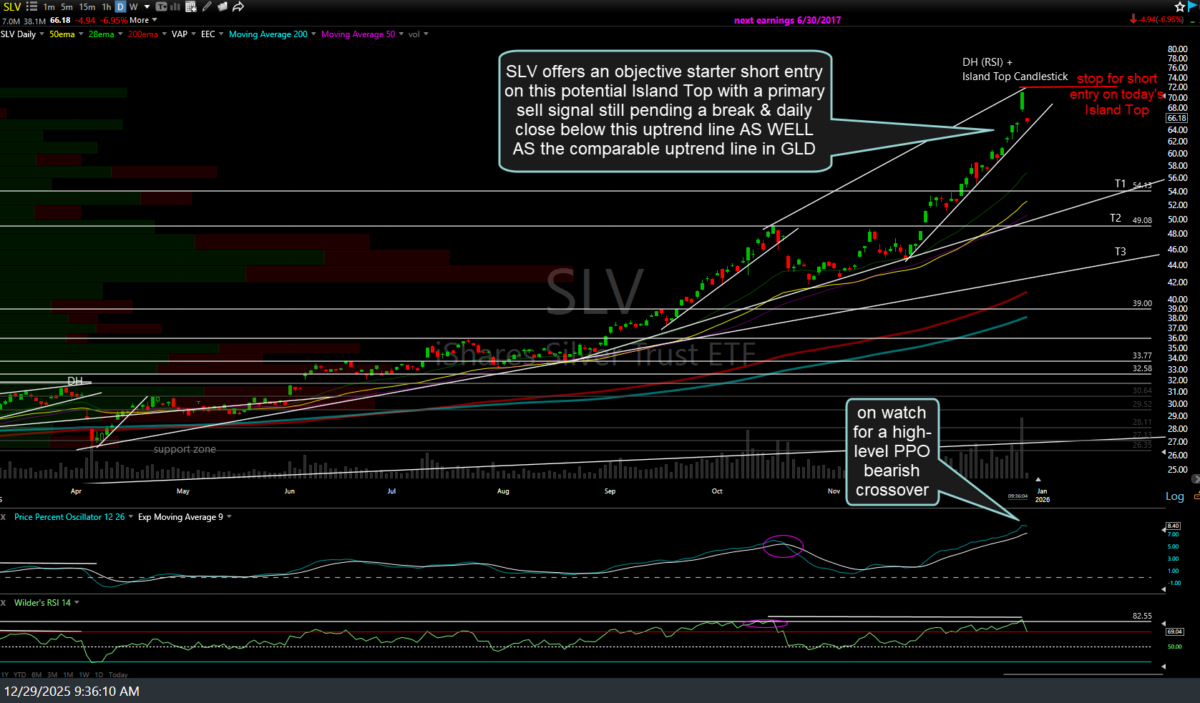

Likewise, SLV (silver ETF or /SI, /QI silver futures) also offers an objective starter short entry on this potential Island Top with a primary sell signal still pending a break & daily close below this uptrend line AS WELL AS the comparable uptrend line in GLD. Ditto for the suggested stop on a starter position taken here (above Friday’s high) and the next sell signal or objective add-on/full position to come on a solid break and/or daily close below the uptrend line. Daily chart below.

An update on GDX (gold miners ETF) will follow soon, especially if GLD & SLV go on to break down below their respective uptrend lines. When/if those uptrend lines are clearly taken out, silver & GDX will likely fall in a multiple of gold. Until then, both remain above their respective uptrend lines now & today’s “potential” Island Top reversal patterns are just that, potential, pending a daily close which separates Friday’s candlesticks with a gap on both sides below it.