The POT (Potash Corp) Growth & Income Active Trade exhibited some fairly bullish price action following what appears to be a capitulation sell-off on Monday as a result of an earnings miss & dividend cut last week. Stops remain on a weekly close below 14.90.

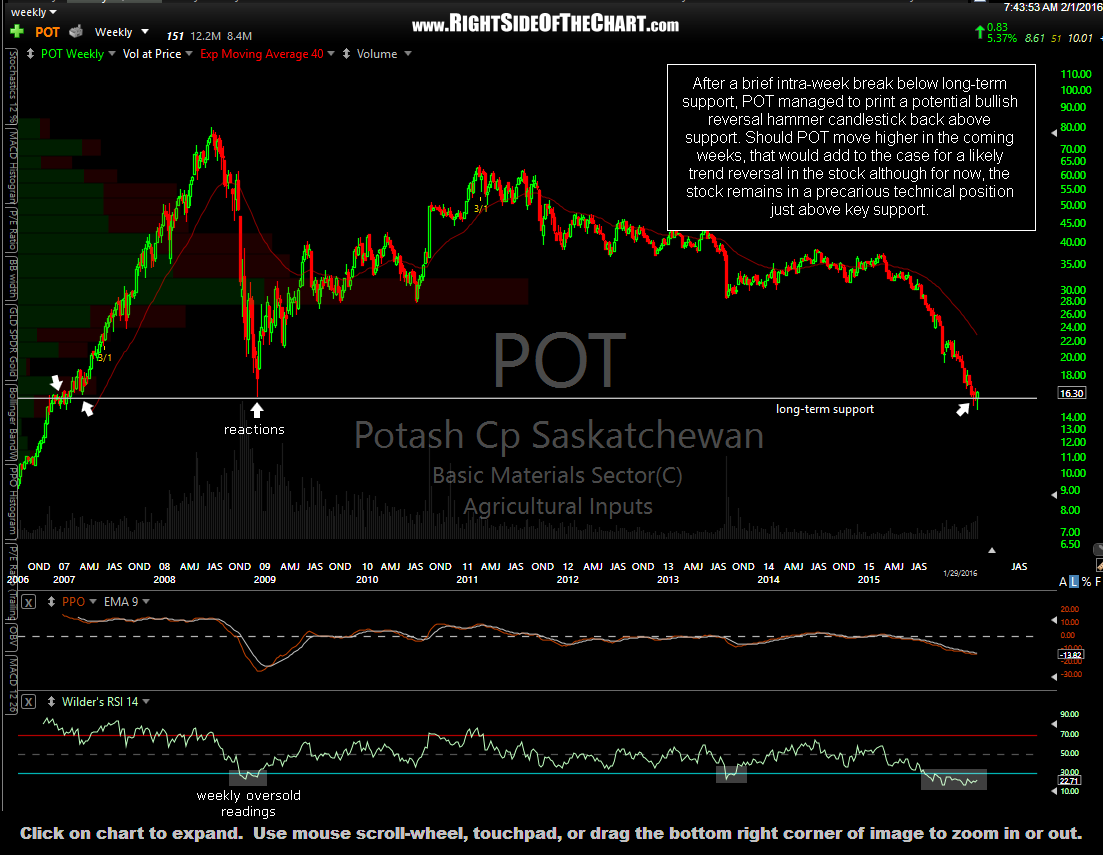

After a brief intra-week break below long-term support, POT managed to print a potential bullish reversal hammer candlestick back above support. Should POT move higher in the coming weeks, that would add to the case for a likely trend reversal in the stock although for now, the stock remains in a precarious technical position just above key support. I’ve also copied & pasted some of the updates/replies to questions on POT that I made in the Trading Room last week in response to the sharp selloff the stock experienced last Monday. (comments pasted below weekly chart).

cheri- FWIW, I’m still holding POT in a couple of long-term accounts (IRAs). My preferred target is T3 so I’m sticking with suggested stop of a weekly close below 14.90. Apparently, the stock is trading down on fear of a dividend cut. The big question is was most of that potential dividend reduction already priced into the stock or not? If so, I’d expect the stock to snap-back by the end of the week (very likely marking an end to the downtrend) and if not, I’ll let it go if it is poised to close below 14.90 on Friday.

Right Side Of The Chart posted an update in the group ![]() Dividend & Income Investing 3 days, 23 hours ago

Dividend & Income Investing 3 days, 23 hours ago

POT poised to open lower on earnings miss/dividend cut, given the stock two trading sessions (thru Friday) to close back above 14.90. Last trade in pre-market was 14.55. If the miss & dividend cut was already priced into the stock, the smart money will likely step in & start buying (sell the rumor, buy the news). If it fails to close above 14.90 this week, POT will be removed from the Active Trades category. (end Trading Room Comments)

Bottom line is the fact that the buyers were able to step in and reverse all of the losses and then some, following the earnings miss & dividend cut, indicates that the worst of the news may already be factored into Potash Corp. The sharp selloff last Monday which briefly took the stock below key long-term support as well as new low of nearly 9-years was also on very high volume, which could indicate a selling climax.