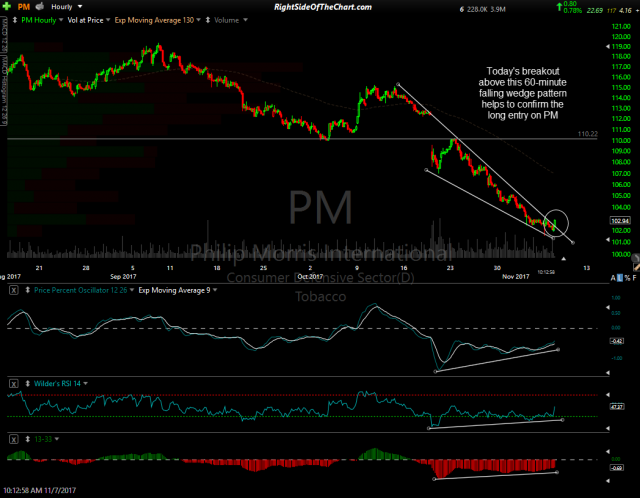

PM (Philip Morris International) offers an objective long entry here at support while extremely oversold on the daily time frame. Today’s breakout above the 60-minute falling wedge pattern also helps to confirm the long entry on PM.

- PM daily Nov 7th

- PM 60-min Nov 7th

The sole price target for the swing trade, which is essentially an “oversold-at-support bounce trade”, is T1 at 104.65 with a second price target for the Growth & Income Trade (as PM has an attractive dividend yield of 4.16%) at 108.92. The suggested stop is any move below 101.65 & the suggested beta-adjustment for the position size is 1.0.