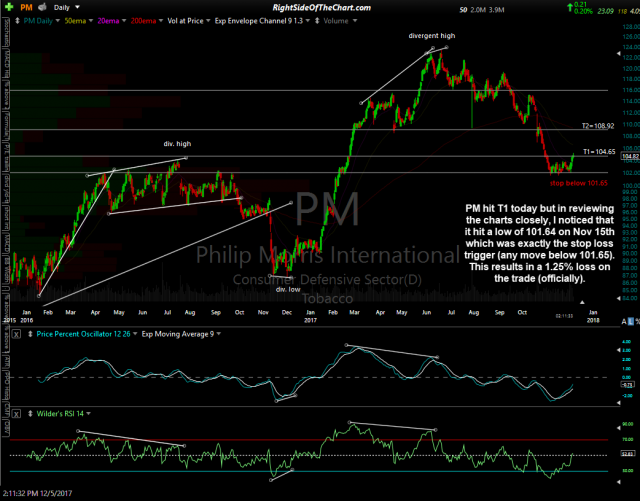

PM (Philip Morris International) Swing Trade + Growth & Income Trade hit T1 today but in reviewing the charts closely, I just noticed that it hit a low of 101.64 on Nov 15th which was exactly the stop loss trigger (any move below 101.65). This results in a 1.25% loss on the trade officially but for those that allowed for a more liberal stop, PM still looks like it might work its way up to T2 (108.92) in the coming months. Previous & updated daily charts:

- PM daily Nov 7th

- PM daily Dec 5th

The stop on this trade was set tight above average using an R/R of 4.6:1 vs. my typical minimum R/R of 3:1, which would have allowed for a $2.00 stop below the entry price of 102.93 when the trade was entered just under a month ago. For those still long PM, I will be glad to provide updates upon requeste going forward but as of now, this trade will be considered stopped out & moved to the Completed Trades archives.