PLUG (Plug Power Inc.) offers an objective, yet aggressive long entry here at support while oversold on the daily RSI with another objective entry or or add-on to come on a breakout above the downtrend line & 30.10ish resistance level on this daily chart. My sole & preferred swing target on the daily time frame at this time is just shy of the 48.60ish resistance level with stops using a 3:1 or better R/R based on one’s preferred price target(s).

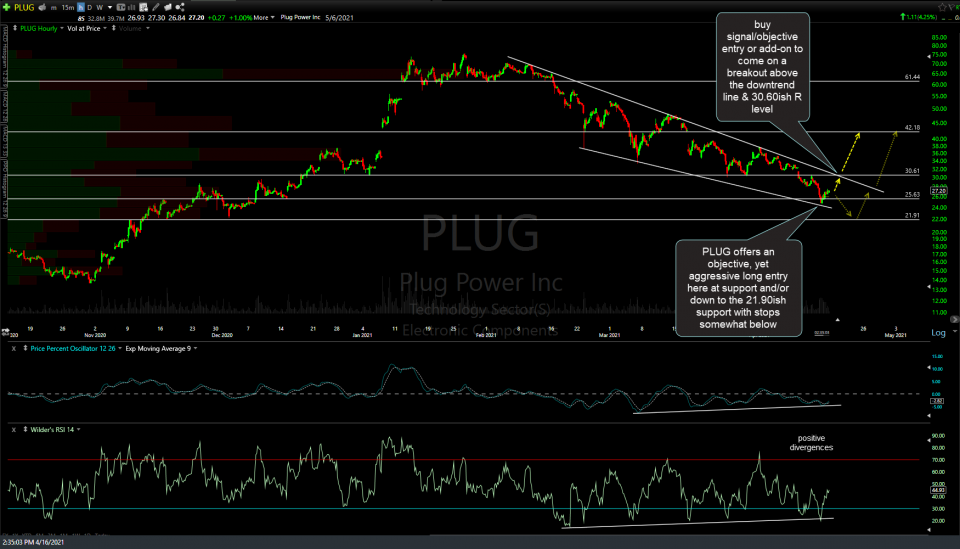

Zooming down to the 60-minute time frame below, PLUG also offers an objective, yet aggressive long entry here at support and/or down to the 21.90ish support with stops somewhat below with alternative targets shown at the arrow breaks. I refer to this as an aggressive trade idea due to the fact this stock is in a clear & powerful near-term to intermediate-term downtrend (but long-term uptrend) without any solid buy signals or evidence of a trend reversal at this time. As always, pass on trade ideas that do not mesh with your trading style or risk tolerance.

ETCG (Ethereum Trust), which was highlighted in Wednesday’s Long Trade Ideas video, has broken out above the 22.44 resistance level, triggering the next objective long entry or add-on with a stop below although the potential (unconfirmed) negative divergences are worth monitoring. Previous daily charts of ETCG below, starting with the downtrend line breakout/buy signal back on Jan 15th, followed by the chart posted on Feb 22nd (the day after suggesting to book profits/sell ETCG right at the highs/22.44 resistance in a video which was followed by a 60% correction), and today’s updated chart.

That’s about all I see that stands out today as most of the recently highlighted trade ideas, as well as the broad market, are consolidating/trading mostly flat today. As such, to be continued next week.

-rp