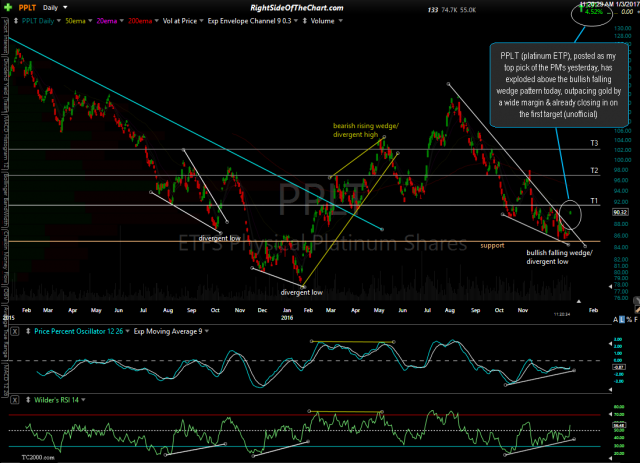

PPLT (platinum ETP), which was posted as my top pick of all the precious metals yesterday, has exploded above the bullish falling wedge pattern today, outpacing the gains in gold today by a wide margin & already closing in on the first target which was posted yesterday (first chart below).

- PPLT daily Jan 1st

- PPLT daily Jan 3rd

PPLT was not yet added as an official trade idea which brings me to my next point. After taking some time off recently during the holidays, I’ve been diving back into the charts with my primary focus over the last few days & throughout the remainder of the week putting together comprehensive outlooks for various asset classes (stocks, bonds, precious metals, commodities, currencies, etc…) as we head into the new year. Within those updates, I make a point to highlight any potential trading opportunities that stand out a actionable at this time as well as those which appear to be setting up for a nice move but might need a little more time before doing so.

Examples were the wheat/WEAT and DBA as couple of my top picks in the agricultural commodities sector & platinum (PPLT) as the most bullish of the precious metals with a very clean chart pattern (falling wedge) in which to provide an objective entry. Unfortunately, PPLT gapped up well beyond the wedge pattern today & as such, didn’t offer the most objective entry as prices gapped about three quarters to the first price target which is a resistance level where a reaction is likely.

As soon as I wrap up the outlook for the most promising asset classes & sectors for the first part of 2017 I will start to focus my efforts on finding & sharing the most promising swing trading & investing setups. I also plan to finish removing all of the trade ideas still listed as Active Trades that have either hit their final price target, exceeded their max. suggested stop or simply no longer look compelling.