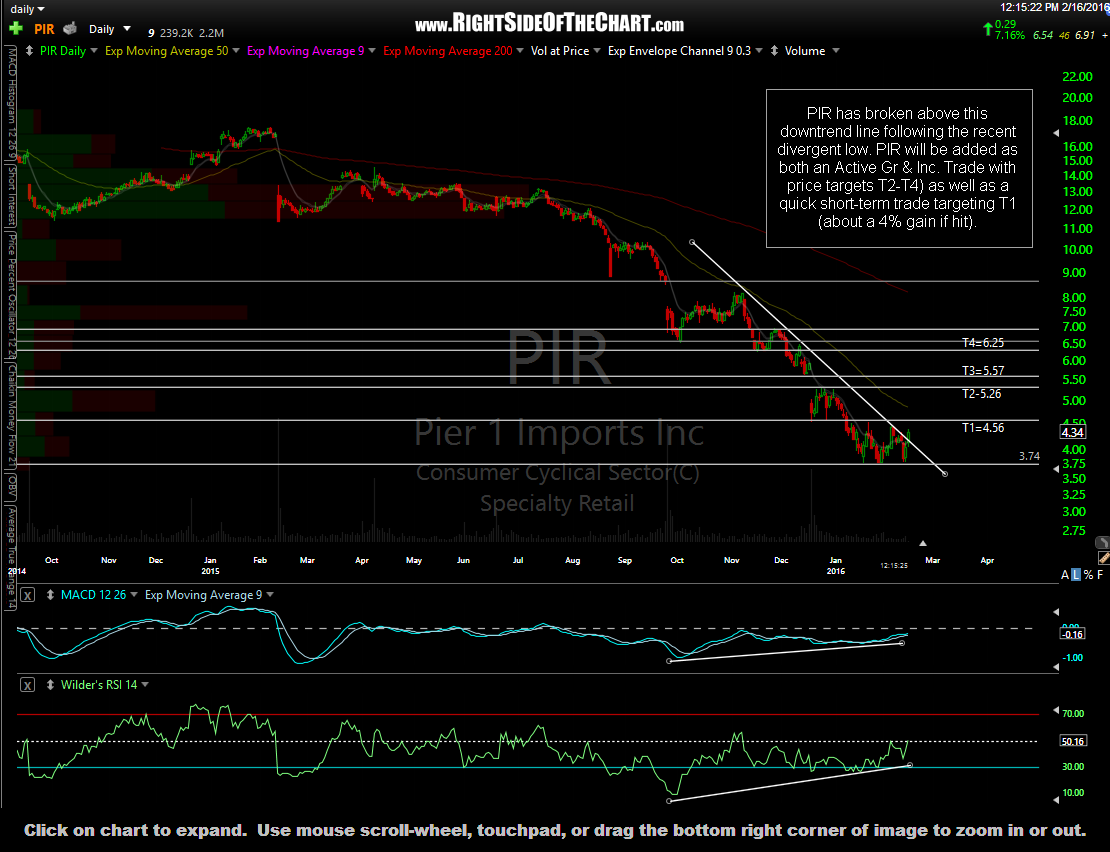

PIR (Pier 1 Imports Inc) has broken above this downtrend line following the recent divergent low. PIR will be added as both an Active Gr & Inc. Trade with price targets T2-T4) as well as a quick short-term trade targeting T1 (about a 4% gain if hit). The current dividend yield of about 6.5% coupled with the potential for considerable capital appreciation (assuming the dividend isn’t drastically cut or eliminated & the stock follows through on today’s breakout) makes Pier 1 an attractive candidate for those looking for long exposure and/or growth & income investment ideas. Of course, the success or failure of this or most long-side trade ideas will depend largely on how the broad markets trade going forward.

With the first target so close (actual resistance at 4.58), a longer-term trader or growth & income investor might opt to take a partial position here, waiting for a break above the 4.60 level before adding. The suggested stop for this trade will be on a 3:59ET close below 3.74. PIR also has decent long-term support at 3.15 on the weekly chart so if this trade is stopped out, it might be added back as a new long entry around that level. Daily chart