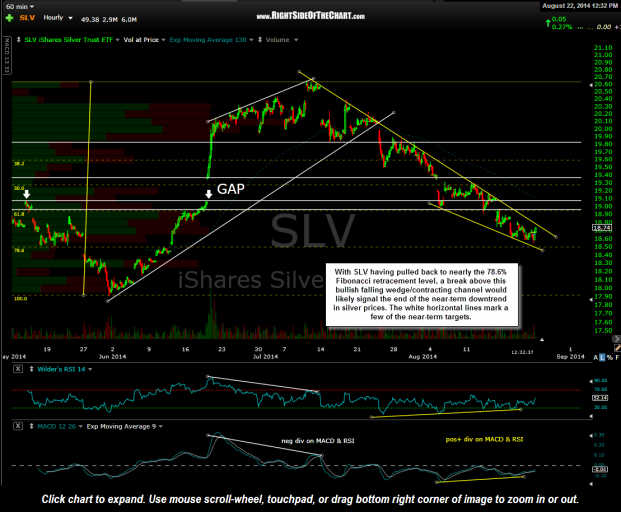

With SLV (Silver ETF) having pulled back to nearly the 78.6% Fibonacci retracement level, a break above this bullish falling wedge/contracting channel would likely signal the end of the near-term downtrend in silver prices. The white horizontal lines mark a few of the near-term targets.

Should prices continue much lower, SLV may test the critical 17.75ish support level that marks the mid-2013 & mid-2014 double bottom lows. Any break & sustained move below that level would have longer-term bearish implications for SLV. By sustained, I am referring to anything other than a relatively brief & shallow break below that support level which could serve as a bear-trap/flush-out move assuming prices were to regain the 17.75ish level shortly afterwards (a bullish event).

As of now, I favor a reversal in both GLD & SLV from at or near current levels but remain open to all possibilities as the precious metals are in a somewhat precarious technical position at this time.