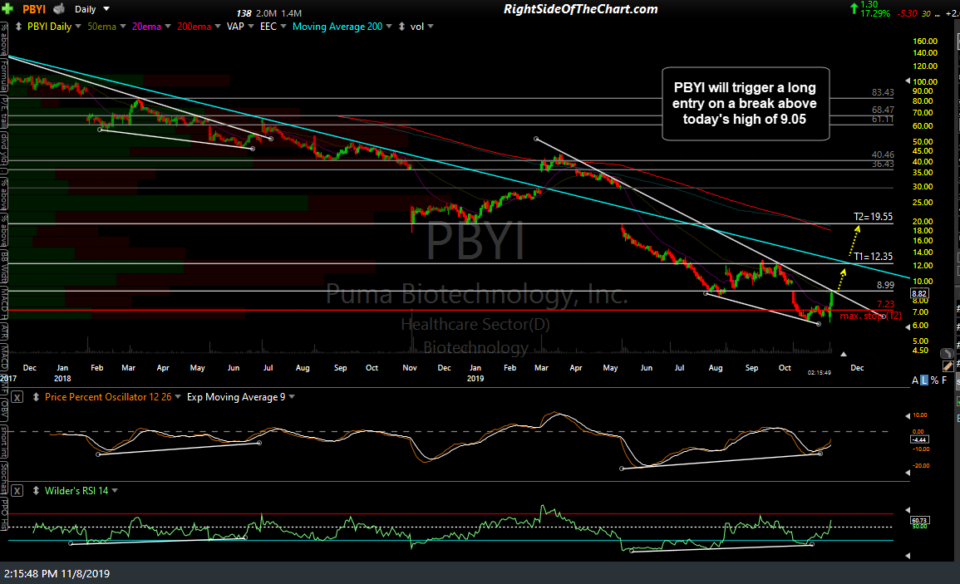

PBYI (Puma Biotechnology Inc.) will trigger a long entry on a break above today’s high of 9.05.

The price targets for this trade are T1 at 12.35 & T2 at 19.55 with a maximum suggested stop (if targeting T2) of 7.23. Due to the fairly aggressive nature & above-average gain & loss potential for this biotech stock, the suggested beta-adjusted position size is 0.65 or less, depending on one’s risk-tolerance & overall exposure to the biotech & somewhat related Generic & Specialty Drug Manufacturers sector, in which numerous trade ideas have been posted here in recent weeks.

To be clear, this is only an untriggered trade setup pending a buy trigger, should the stock take out today’s earlier high of 9.05. As of now, the stock remains below both the 9.00 price resistance & intersecting downtrend line resistance.