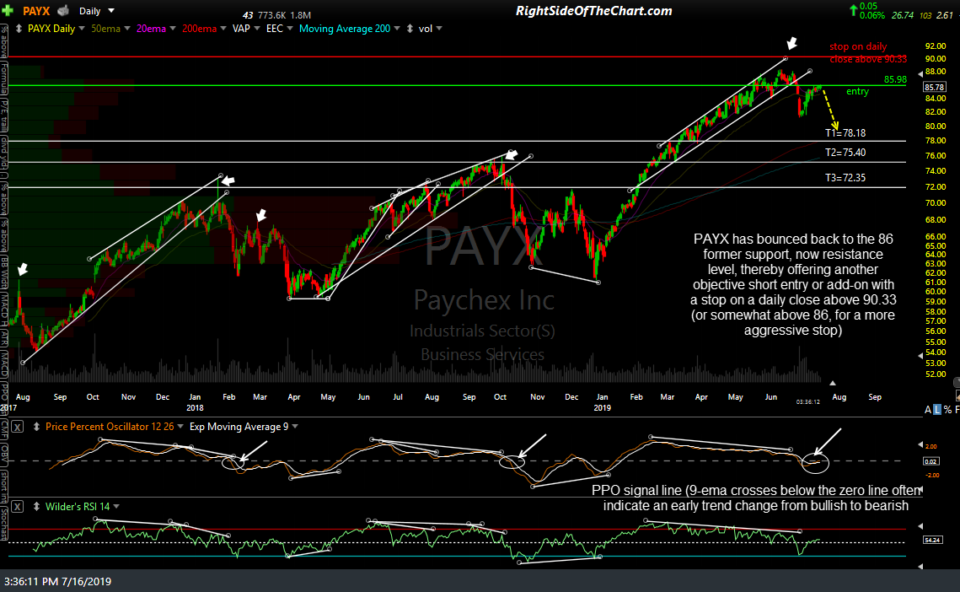

The PAYX (Paychex Inc.) Active Short Trade has bounced back to the 86 former support, now resistance level, thereby offering another objective short entry or add-on with a stop on a daily close above 90.33 (or somewhat above 86, for a more aggressive stop). Support, once broken, becomes resistance just as resistance, once broken, becomes support.

Also, note the current posture of the PPO signal line (9-ema) which made a bearish cross down below the zero line recently & remains below for now. PPO signal line (9-ema crosses below the zero line often indicate an early trend change from bullish to bearish as was the case shortly after the previous two major sell signals/uptrend line breaks & divergent highs back in 2018 & 2017 as shown on the chart above.

As with any trade, this one will either pan out or not… it’s really that simple. However, nothing that I see in the charts at this time convince me to modify the trading plan on PAYX although ideally, the stock should start to move lower now that the 86 level has been backtested. I will also add that while this appears to be another objective shorting opp (which is also just below the original entry of 85.98), I would not add to or initiate a short position on PAYX above 86, only below that level.