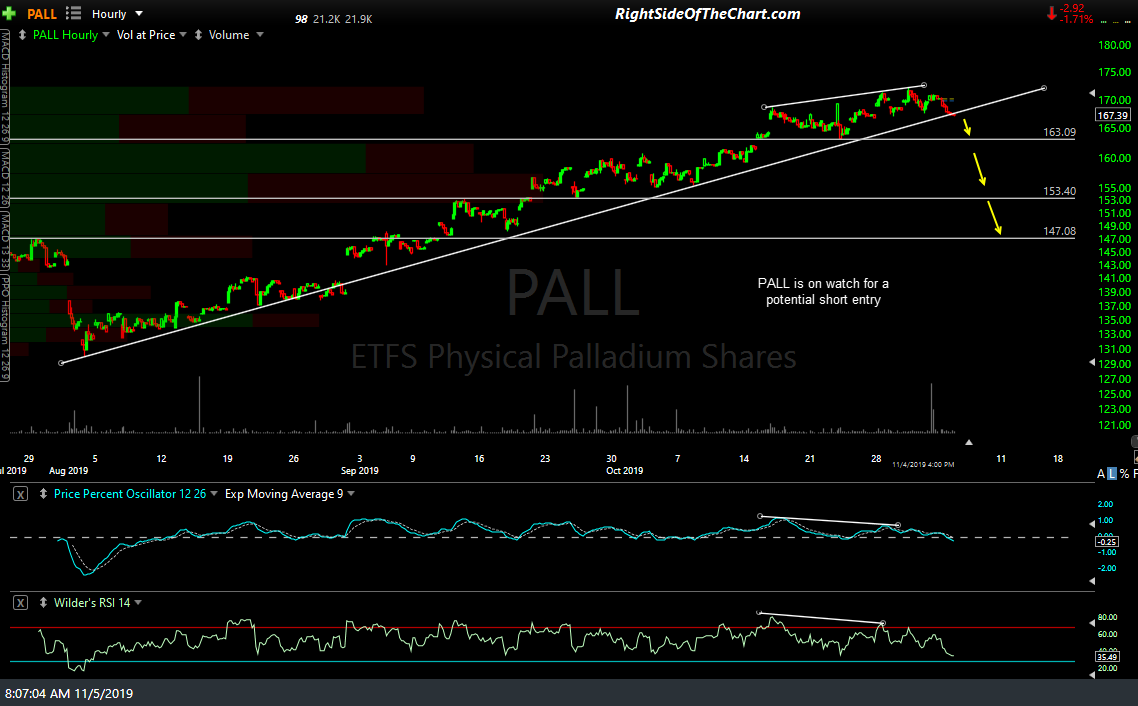

PALL (palladium ETF) remains on watch as a potential official short swing trade. PALL closed on trendline support yesterday (1st 60-minute chart below) while /PA (palladium futures, 2nd chart below) has broken trendline support following the recent divergent high & is starting to crack below the 1739ish support with more downside likely whether or not it prints a 60-minute close back above 1739.

- PALL 60m Nov 4th close

- PA 60m Nov 5th

The bull trend in palladium has been unusually resilient for months now so I’d prefer to err to the side of caution as far as an entry on an official trade goes but I wanted to get these charts out in advance in case I suddenly decide to pull the trigger on an official short trade. On a related note, /PL (platinum futures) and the platinum ETF, PPLT also recently put in a divergent high on the 60-minute chart & has just broken below trendline support & may also be posted as a trade setup shortly.