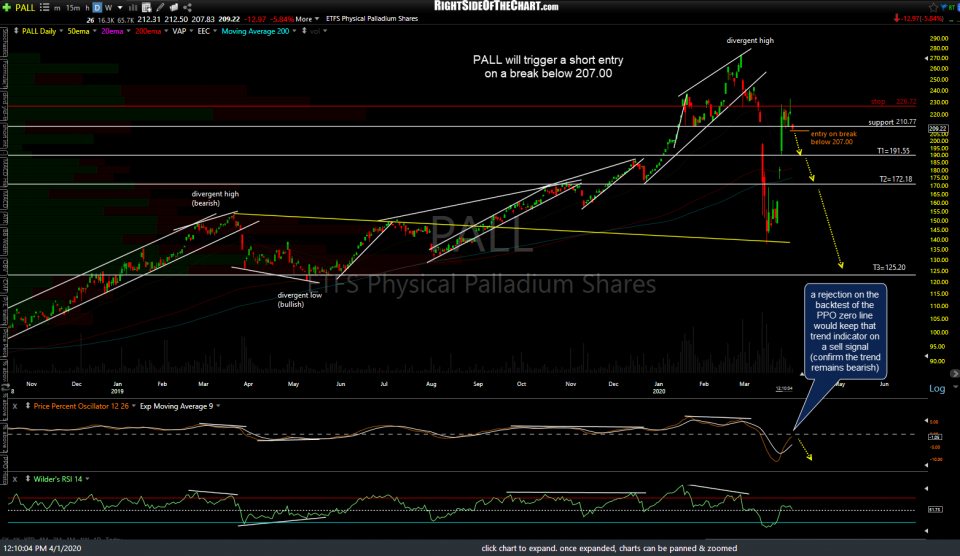

PALL (palladium ETF) appears poised for a significant drop in the coming weeks & months+ and will trigger a short entry on a break below 207.00 (i.e.- It will become an Active Short Swing Trade, should the ETF cross below 207.00).

The price targets for this trade are T1 at 191.55, T2 at 172.18, and T3 at 125.20 with a suggested stop of 226.72. Due to the above-average volatility of palladium prices coupled with the above-average gain/loss potential for this trade, the suggested beta-adjusted position size is 0.80 (or less, depending on one’s risk tolerance).

/PA (palladium futures contract) has just backtested the Ascending Broadening Wedge Pattern (blue lines) from below following the recent breakdown & snapback rally with the next sell signal to come on a break below this intersecting trendline + 2116ish support, which also aligns with the 210.77ish support on the daily chart of PALL. The entry trigger was set a few points below for a margin of error to minimize the chance of shorting on a whipsaw signal (false breakdown) as well as the fact a drop below 207 will have taken out today’s low of 207.83.

A couple of notes on this trade idea: First off, this is a trade setup pending on entry at which point (assuming the entry trigger is hit), it will become an Active (official) Short Trade. PALL is the only direct play on profiting from a drop in palladium prices other than /PA, as there is not an inverse (short) ETF for palladium.

Shorting a relatively thinly traded ETF like PALL runs the risk of your broker calling in the shares (i.e.- buying in or closing out your short position) if they no longer have enough shares to lend to you and are unable to locate & borrow them from another broker. Should that occur, the timing of a buy-in may or may not be advantageous to your trade although it is beyond your control.

Interactive Brokers typically has the best availability of HTB (hard-to-borrow) shares of stocks & ETFs & currently has at least 2,330 shares available to short while some other brokers may not have shares available to short. As a HTB security, the interest rate to short PALL will be higher than more widely held stocks & ETFs such as SPY or AAPL, although if this trade pans out, the interest expense should be more than offset by the profit on the trade.

With the recent surge in market volatility, many brokers, including Interactive Brokers, have significantly raised their margin requirement & as such, a short on just a signal contract of /PA will require (and use up) a very large amount of buying power in your margin account. As always, pass on trades that don’t mesh with your comfort level, risk-tolerance, experience and/or outlook for that particular security.