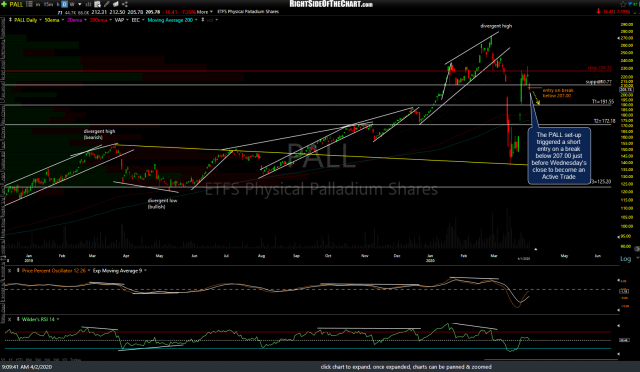

The PALL (palladium ETF) Active Short Swing Trade idea gapped below the previous first target price of 191.55 to open at 179.86, where any standing BTC (buy-to-cover) limit orders at 191.55 would have been filled. This provides a 13.1% profit for those targeting T1. For those targeting T2 or T3 (and additional targets are still likely to be added to this long-term trend trade), consider lowering stops to entry or lower at this time in order to protect profits. Original & updated daily charts of PALL charts below. (multiple charts in a gallery format, as below, will not appear on the email notifications but may be viewed on rsotc.com)

- PALL daily April 1st

- PALL daily April 1st close.png

- PALL daily April 21st

An update on /PA (palladium futures) was posted before the opening bell today & may be viewed by clicking here.