As of 3:42 am EST earlier in the overnight session, /PA (palladium futures) made a perfect & typical 38.2% Fib retracement on what still appears to be a counter-trend bounce with what may likely prove to be a larger correction with more downside to come.

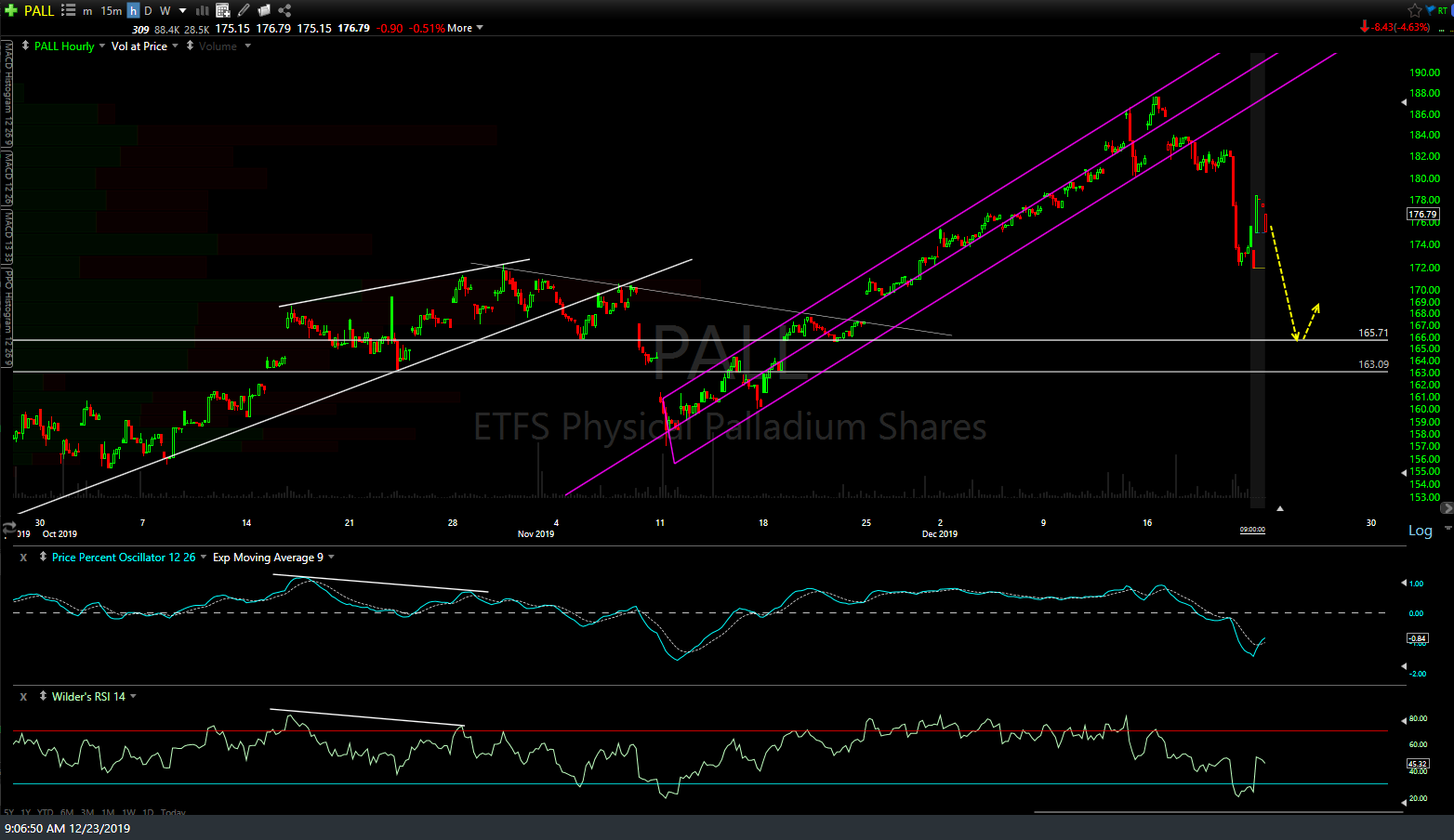

/PA briefly spiked lower when trading opened last night due to order imbalances in the typically low-volume Sunday evening trading session, making a very brief spike below the key 1800 support followed by a quick snapback rally above. There’s no way to say definitely if palladium already has or soon will resume the downtrend that started last Monday although the next solid break below 1800 & especially below last night’s lows would increase the odds of a continued drop to the 1742ish support/target (roughly 165.70 on the palladium ETF, PALL as shown on the 60-minute chart below).

As such, one could add to or initiate a short position here and/or wait for a break below 1800 or this morning’s low using a stop inline with your average entry cost, price target(s) and a favorable R/R of 2:1 or better.