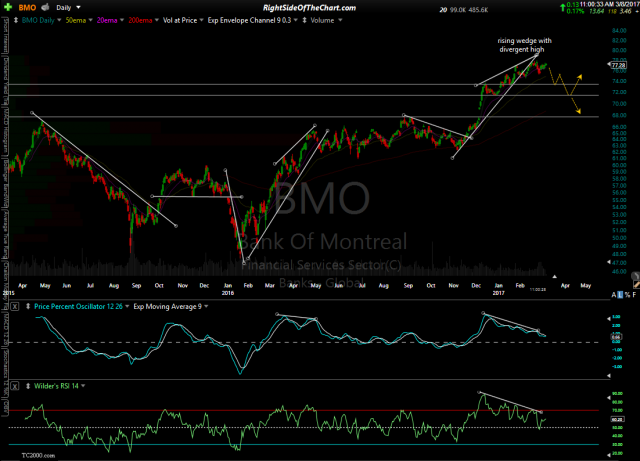

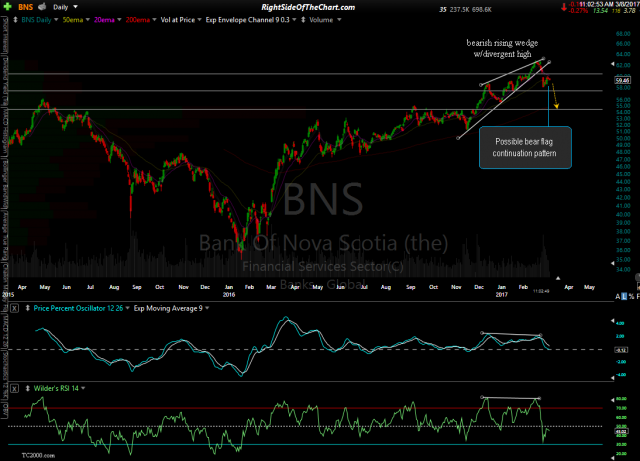

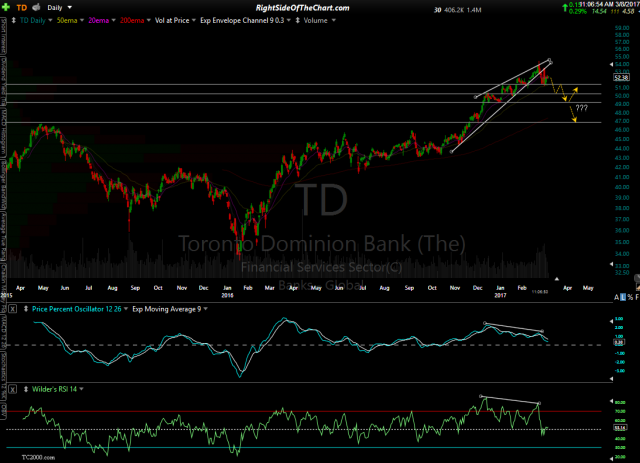

Member @lee1 inquired about my outlook for the Canadian bank sector including BMO (Bank of Montreal), BNS (Bank of Nova Scotia) & TD (Toronto Dominion Bank). My expectation at this time is for at least a 5-6% correction in the Canadian banking sector which roughly aligns with my expectation for a similar pullback the US banks. I’ve also highlighted my preferred scenarios with price targets & expected counter-trend rallies on the charts of the 3 big Canadian banks on the charts below.

- Canadian Bank Sector March 8th

- BMO daily March 8th

- BNS daily March 8th

- TD daily March 8th

Click on first chart to expand, then click anywhere on the right of the expanded chart to advance to the next chart. Once expanded, each chart can be further zoomed and panned.