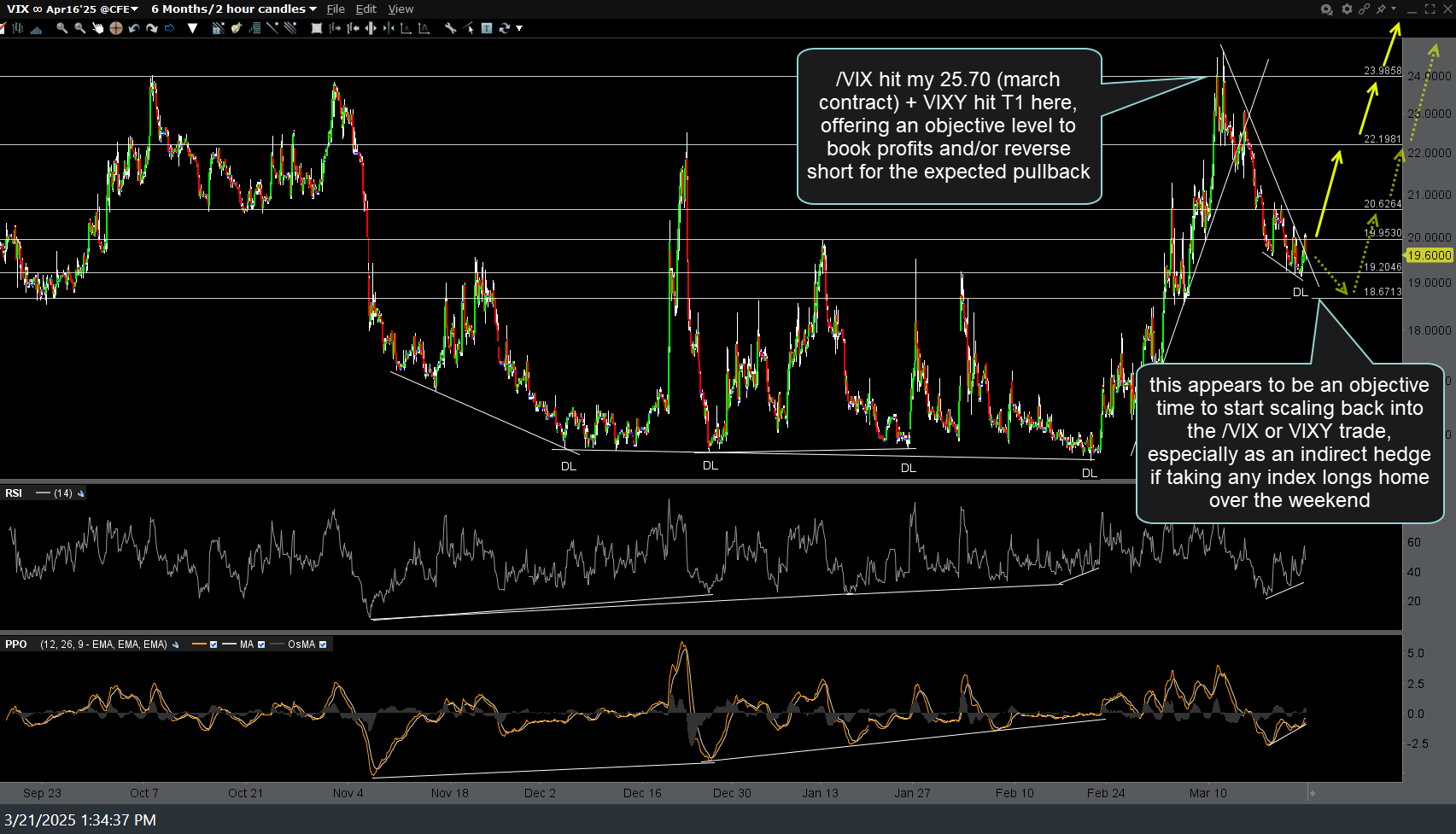

This appears to be an objective time to start scaling back into the /VIX or VIXY trade, especially as an indirect hedge if taking any index longs home over the weekend. The previous two 120-minute charts of /VIX ($VIX futures, March contract so the price levels at the same reaction/support/resistance levels are different) posted followed by the updated 120-minute chart below. We essentially milked every cent of that 50% run off the divergent low, reversed it there & milked a good part of this (so far) 20%+ pullback reversing there (personally, I covered a week or so ago but starting to scale back in long today), and will continue to add to that position on either weakness or strength, until & unless something convinces me otherwise next week.

Previous (Jan 30th, March 10th, & March 12th) & updated daily charts of VIXY ($VIX near-term futures ETF) for those preferring to trade ETFs in lieu of futures below.

To reiterate, my preference is to start scaling back into the $VIX long here either as a pure-play and/or a hedge to any index long (or closely related, e.g.- Mag 8 stocks) positions. I will assess the charts next week to determine whether to add or subtract (close out/remove hedge) this $VIX long position.

I also feel that while the $VIX certainly can & likely will continue to fall next week, should the stock market rally, it appears that the R/R is no longer favorable for shorting or remaining short the $VIX as it is getting close to the low-end of its 2024-2025 range.