In the same comment thread below this post earlier today where @seasix mentioned the SMCI (Super Micro Computer Inc) that I replied shorting it (and also covered here in today’s earlier video), trade0039 asked for an update on the semis & mentioned that NVDA (NVIDIA Corp) is reporting next week (Wed AMC).

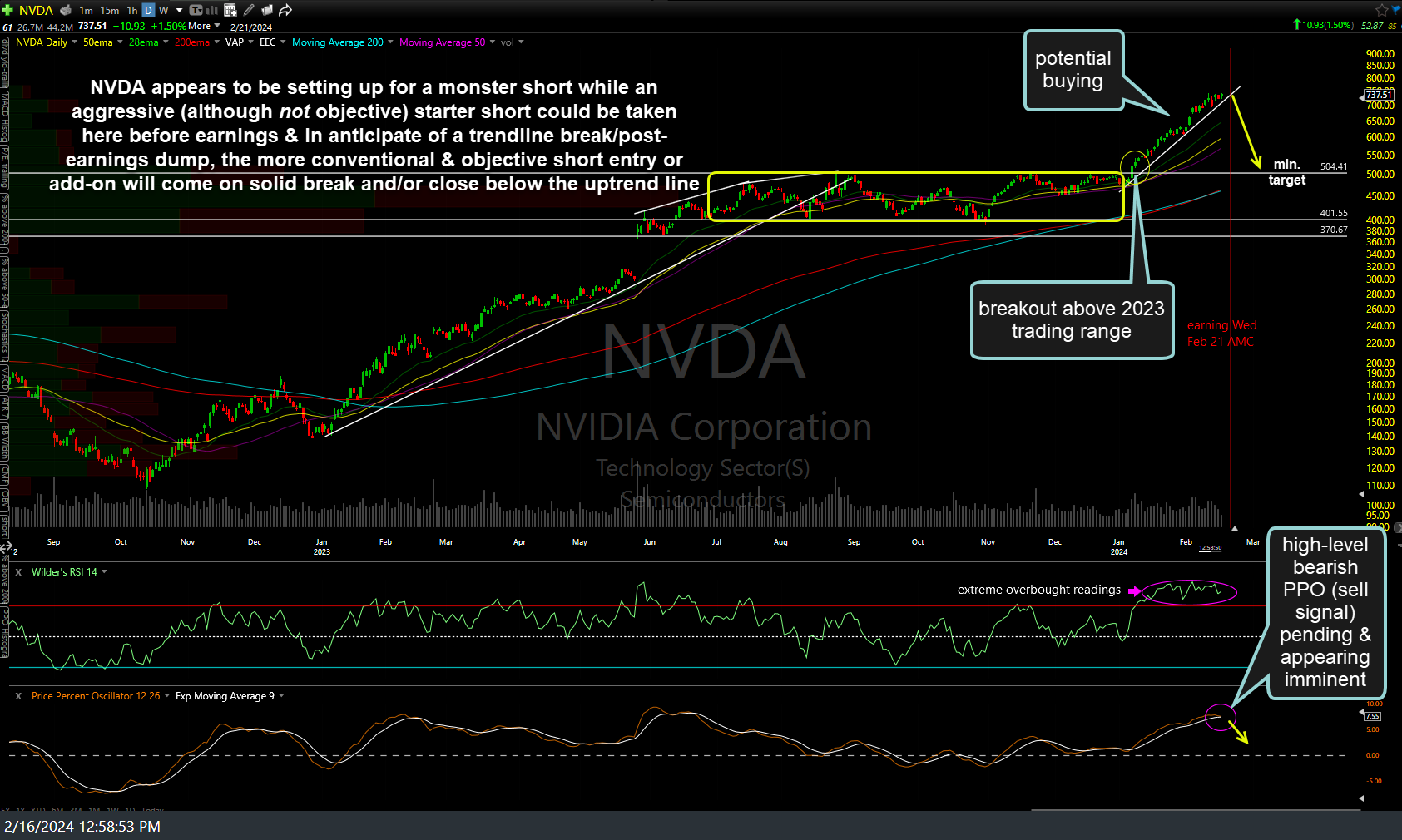

I’ve been watching NVDA closely for a while now, patiently awaiting the right time to start scaling into a short position for what I plan to be, at minimum, a swing trade measuring back down to the 638ish level (a 14% drop from where I just took a small starter position) & quite likely down to the 500ish key support level (32% drop from current levels). Actually, let me start with SMCI which, again, was covered in today’s previous video although I noticed some striking similarities between the charts of these two.

SMCI offers an objective short on today’s bearish engulfing candle with a stop above it and/or on a solid break below the uptrend line. An additional sell signal will come (or provide confirmation of a trendline break) on a high-level bearish crossover on the PPO, which appears likely now that the PPO has turned down from extreme levels. As per my earlier comments, the recent price action since SMCI (as well as NVDA) broke out above the 2023 sideways trading range appears to be a buying climax (aka- blow-off top). My sole swing target on SMCI at this time is just above the 355.60ish support.

Just as I shorted SMCI with literally nothing remotely close to resembling a sell signal shortly after the open today after @seasix brought it to my attention (thanks!), there isn’t anything remotely close to a sell signal on NVDA at this time. However, at times I will take a trade on a gut feel when I think the R/R is very favorable or, in the case, the likelihood of a sudden & swift reversal, including for the potential of a big opening gap, that might deny me an objective entry (I typically won’t chase a breakout that is too far below the entry level I was looking for). With that being said, NVDA appears to be setting up for a monster short while an aggressive (although not objective) starter short could be taken here before earnings & in anticipation of a trendline break/post-earnings dump, the more conventional & objective short entry or add-on will come on solid break and/or close below the uptrend line.

Now while SMCI has already been good for a quick (4-hr) gain of 23%, it is still far from my preferred swing target another 55%+ below. However, I find the similarity of these two charts quite striking & whether or not either of these trades pan out (SMCI would be hard not to as I’ve lowered stops in case it bounces off this trendline), the takeaway is what a crowded rush for the exits looks like when the music stops on an over-owned, over-loved, & very overbought stock.

It should go without saying that IF (and that’s a big IF) NVDA does drop hard in the weeks to months following next week’s earnings, that will almost certainly take the entire semiconductor sector down with it (as their undisputed leader) but also the entire stock market as well, being that NVDA is also the undisputed poster child of the AI bubble which has driven the group of stocks FKA The Magnificent 7 (now Mag 5 & counting down). Maybe, maybe not but I still need to see the quad sell signals I’ve been talking about this week (Tuesday’s lows taken out on SPY, QQQ, META, & AMZN) before moving to a more aggressive swing short positioning.