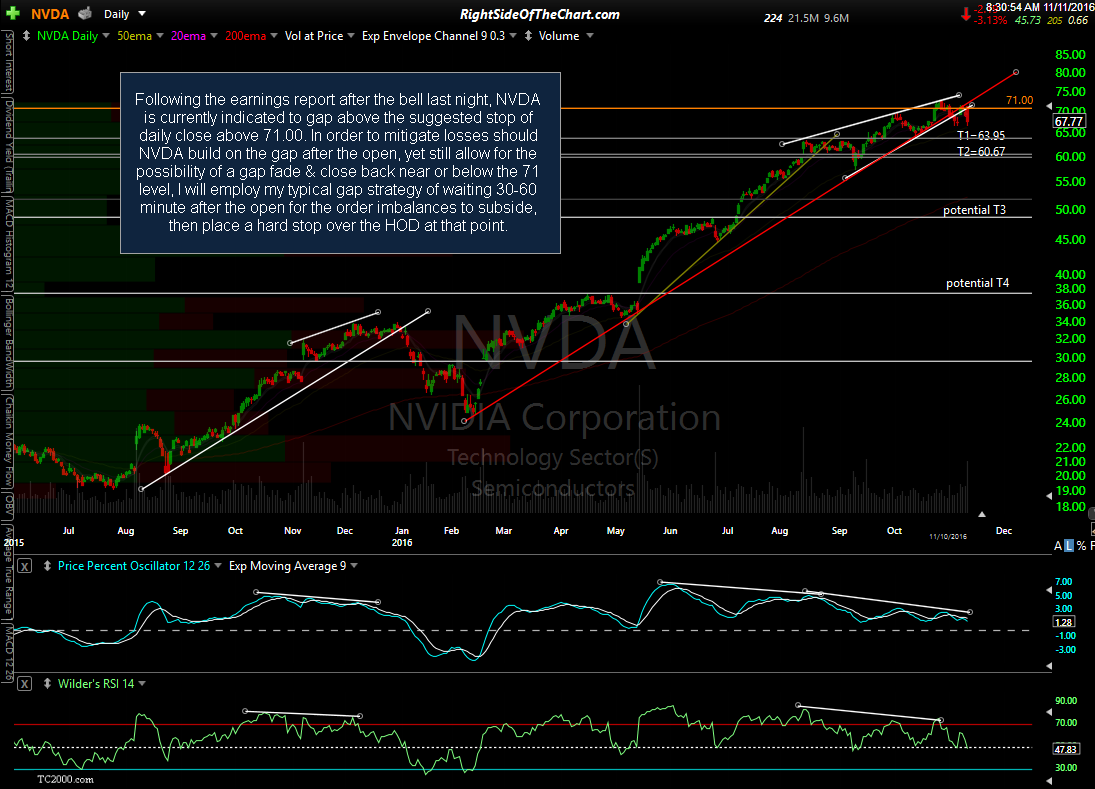

Following the earnings report after the bell last night, NVDA (NVIDIA Corp) is currently indicated to gap above the suggested stop of daily close above 71.00. In order to mitigate losses should NVDA build on the gap after the open, yet still allow for the possibility of a gap fade & close back near or below the 71 level, I will employ my typical gap strategy of waiting 30-60 minutes after the open for the order imbalances to subside, then place a hard stop over the HOD at that point.

This strategy, while sometimes resulting in a somewhat larger loss than I would have taken would I have closed the trade at the open, has in many instances allowed me to close the position at a much more favorable price as order imbalances (i.e.- many more buy orders than sell orders or vice versa) often cause prices to shoot well beyond the level where the stock price normalizes after those order imbalances are absorbed. In several instances while using this strategy, I’ve had the trade go on to fade the entire gap & then some, ultimately going on to play out as expected by hitting my price target. This strategy works equally well when caught on the wrong side of a gap on a long or short positions.

Essentially, you run the risk of a slightly larger loss that you would have taken if you leave your standing stop-loss order open at the close as GTC buy-to-cover stop-loss orders on a short trade like this are converted to & filled as market orders at the open as soon as the stop price is hit or exceeded, thereby adding it to the overwhelming amount of other buy orders at once. However, by waiting for those opening order imbalances to subside (cancelling your GTC stop-loss order if you already have one open) & then placing a stop-loss order just slightly above the highest price traded after the first 30-60 minutes, you have the potential to stay in the trade if the gap is faded.

As of now, the suggested stop on the NVDA short trade remains a daily close above 71.00 with the possibility that I may revise that stop at least 30 minutes before the close, depending if the gap is faded & how the broad market & semiconductor sector trades throughout the day.