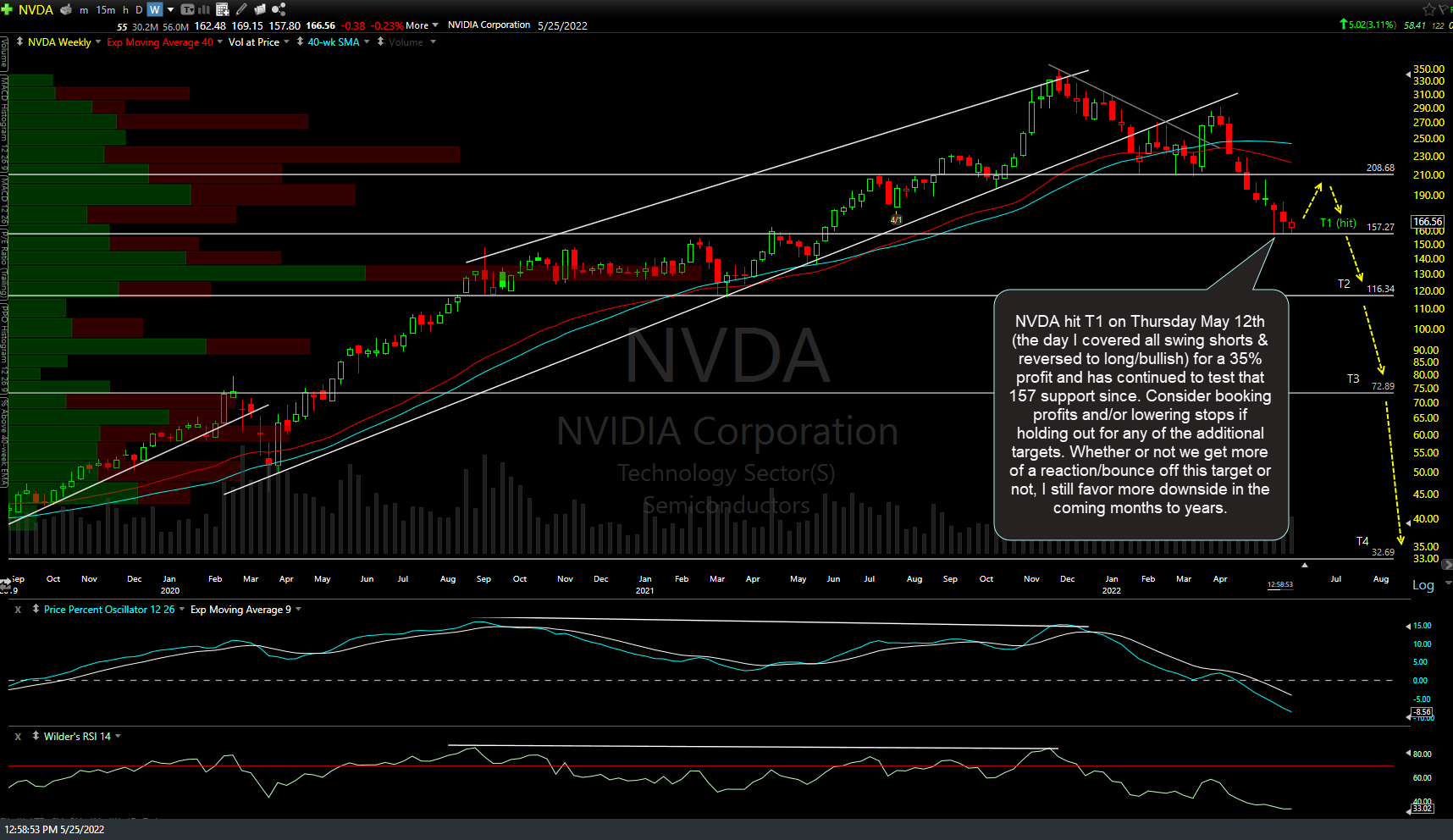

The NVDA (NVIDIA Corp) swing/trend trade idea first posted/shorted back in this post from Feb 3rd hit the first price target (T1 at 157.27) on Thursday May 12th (the day I covered all swing shorts & reversed to long/bullish) for a 35% profit and has continued to test that 157 support since. Those that took the trade might consider booking profits and/or lowering stops if holding out for any of the additional targets. Whether or not we get more of a reaction/bounce off this target or not, I still favor more downside in the coming months to years.

However, keep in mind that NVDA reports earnings tonight after the market close and as such, the stock will likely make a large gap up or down at the open tomorrow & therefore, I believe it would be prudent (for those that haven’t already done so) to book full profits & re-enter the short (or a potential bounce long trade) after earnings are out of the way.

While the next objective short entry might come on a bounce back up to resistance and/or other signs that any post-earnings rally has likely run its course, a solid break below the 157 support may also provide another objective re-entry or new short entry, depending on how the chart of the $NDX & semiconductor sector look at the time. The first weekly chart below is from the short entry posted back on February 3rd followed by the updated (zoomed in) weekly chart.