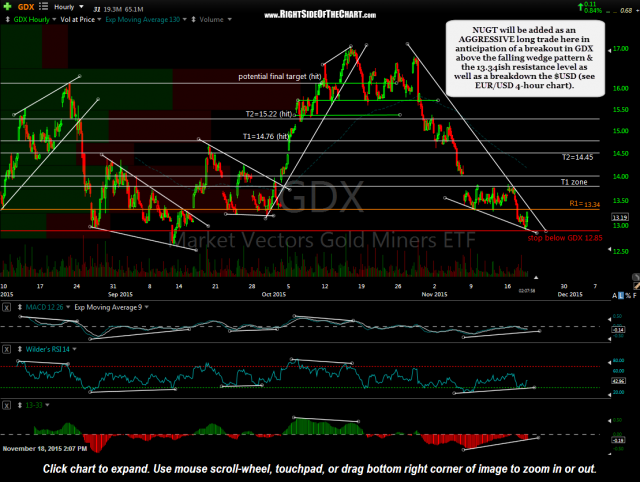

NUGT (3x long gold miners ETF) will be added as an AGGRESSIVE long trade here in anticipation of a breakout in GDX above the falling wedge pattern & the 13.34ish resistance level as well as a breakdown the $USD (see EUR/USD 4-hour chart). Current price in NUGT is 22.97 although as usual, I’m using the chart of the non-leveraged (1x) GDX to time my entries & exits on this trade.

- GDX 60 min Nov 18th

- EUR-USD 4 hour Nov 18th

My first profit target is the T1 zone which runs from about 13.80-14.00 on GDX with a second price target, T2, at 14.45 and a suggested stop on a daily close below 12.85 (all those levels are on GDX). A more conventional entry or an objective add-on to an partial position taken here in anticipation of a breakout in the miners would be to wait for a confirmed breakout of GDX above both this 60-minute downtrend line & the 13.34 resistance level AS WELL as a breakout of the EUR/USD above that steep descending price channel shown on the 4-hour chart above (most likely, both breakouts will occur in close proximity).