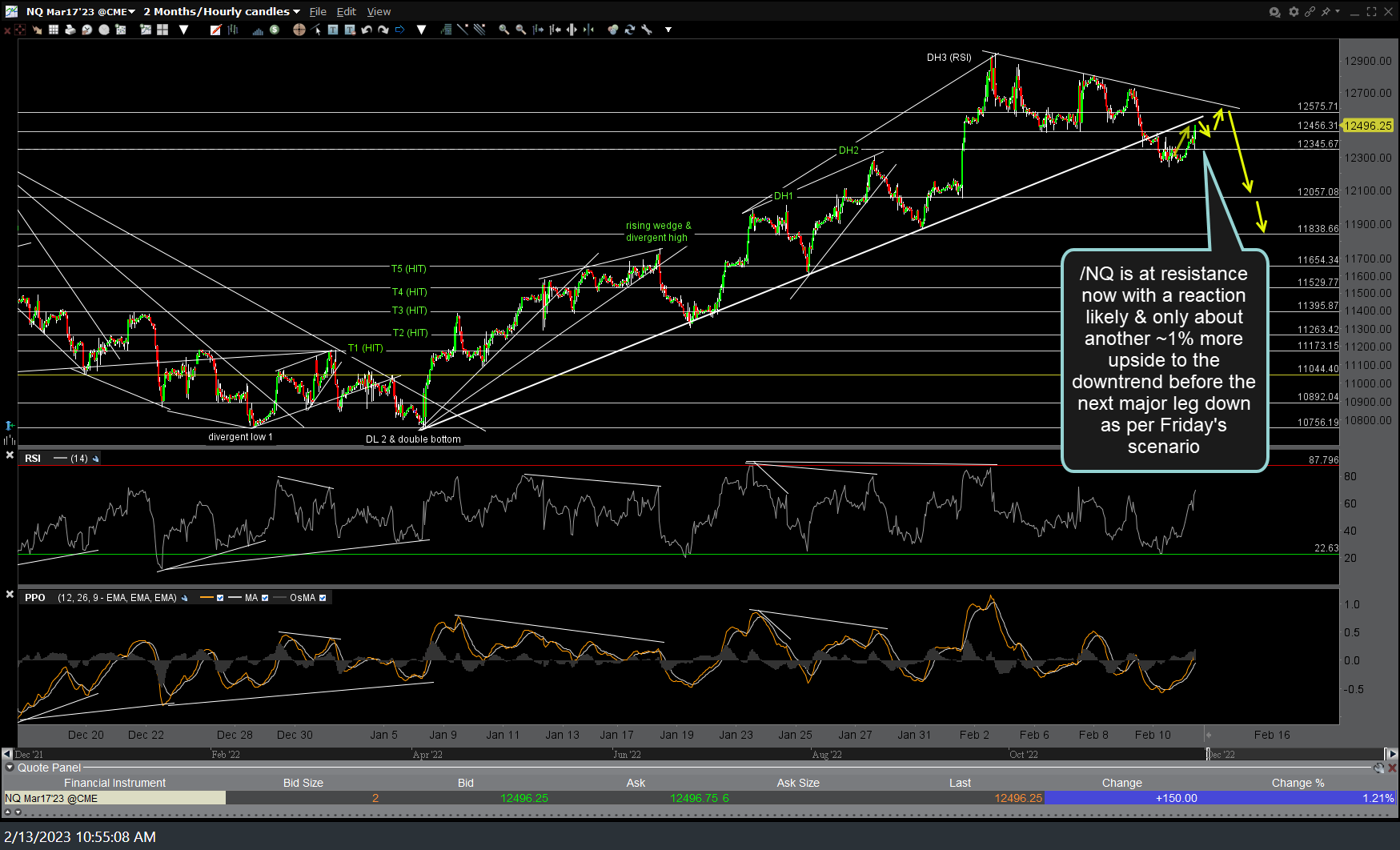

/NQ (Nasdaq 100 futures) is at resistance now with a minor reaction likely & only about another ~1% more upside to the downtrend before the next major leg down as per Friday’s scenario (first chart below). Previous & updated 60-minute charts.

However, in Friday’s scenario, I underestimated how long it might take to rally up to test that downtrend line thinking that /NQ would hit the downtrend line late Friday with the reversal starting then & carrying over into today. A thrust up to that downtrend line off the recent highs would provide another objective short entry or add-on with the potential for a marginal new & divergent high still very much a possibility, especially with the fact they are bidding up the equity markets today & may foil or temporarily delay the bearish PPO crossovers on the daily charts of QQQ & SPY. As such, this still isn’t a ‘hard’ or ‘full’ short moment just yet with my preference taking or scaling into a starter swing short position while waiting for the additional ‘check marks’ (sell signal/bearish developments) covered in recent videos.

I have some errands to take care today & with the indexes still pinched between support & resistance as the sideways grind continues, this is about as a good a day to take off as any. If anything crazy happens today I’ll get a post(s) out asap. Otherwise, I’ll probably just post a brief post-market wrap later today.