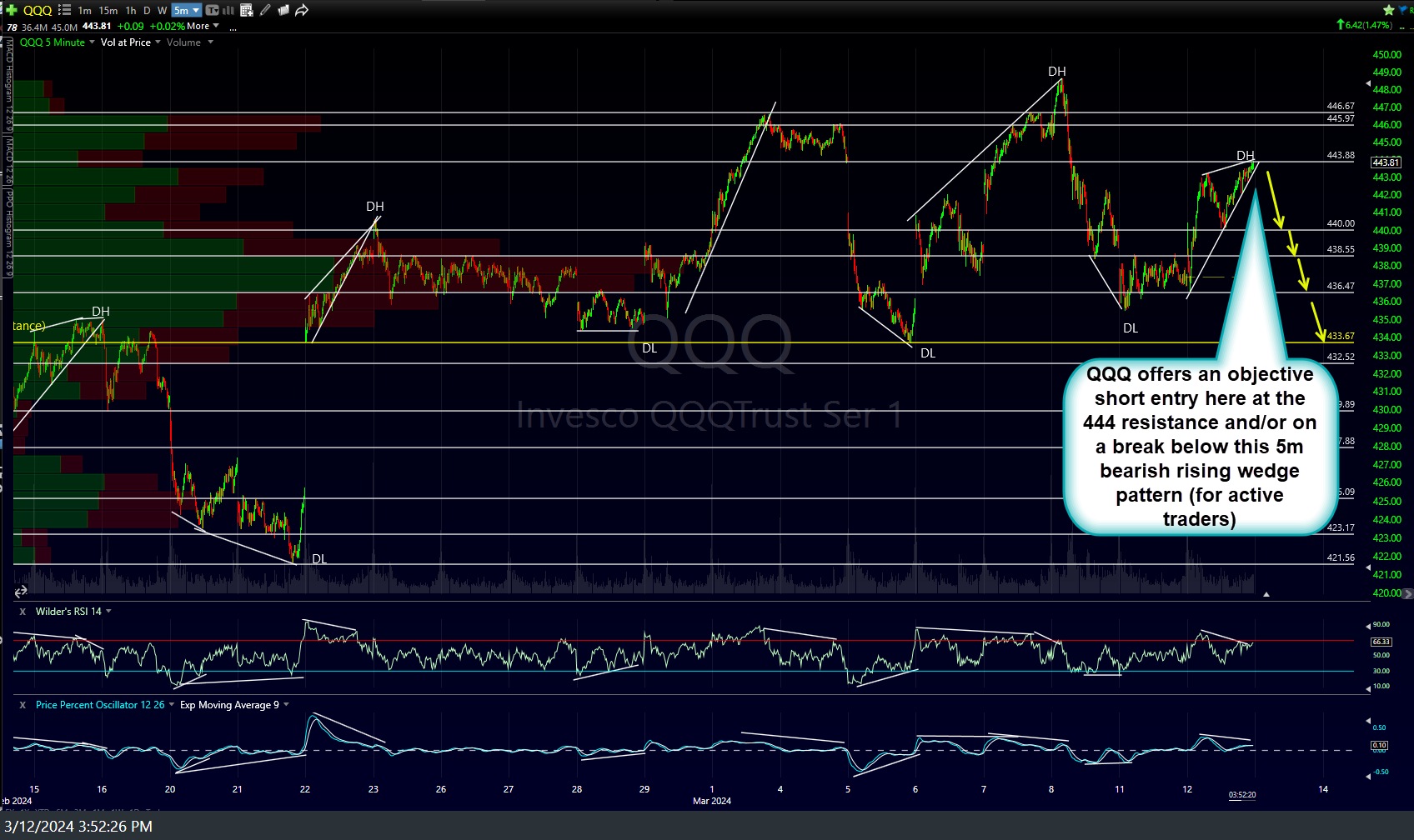

The /NQ & QQQ “active trader” short trade posted shortly before the close on Tuesday has just hit the final target for a quick (under 2 full trading session) gain of 2.3%, where the odds for a reaction (and another potential opportunity for active traders to reverse to long in order to game a quick bounce) are elevated. Previous & updated 5-minute (QQQ) and 15-min (/NQ) charts below.

For those new to active and/or swing trading, or my style of trading, this post may seem contradictory to my previous post which highlighted some of the additional sell signals I’ve been waiting for on the top sectors of the S&P 500. Very important not to confuse what’s happening (or what I’m trading) on the very short-term intraday charts (1-15 minute time frames) with what is happening on the longer-term intraday (i.e.- 60-minute), daily, & weekly charts as the former are the realm of the active trader & the latter much more significant/relevant to typical swing & trend traders (as well as investors).

As an active trader, I will often try to thread the needle by gaming some of the (what I call) micro-squiggles in the market in my active trading account, when the market is conducive to that type of trading. However, at this time, other than a quick reflexive bounce off the 433.67ish support on QQQ, unless that bounce carries the indexes as well as those top four sectors of the S&P 500 solidly back above their recent breakdown levels, my plan is to shift back to more of a focus on typical swing trading where I’ll be less interesting in gaming small bounces off support.

My reasoning behind that is when the market is topping, as I suspect it has been in recent weeks & months as momentum has clearly slowed, the major indices are more conducive to active trading as it moves mostly sideways in a trading range with well-developed support & resistance levels in which to actively trade from. Once the recent sell signals on the daily chart become clear to most, especially if when we get the additional sell signals (key yellow support levels) taken out of the majority of the FKA Mag 7, then it is likely that these same minor support levels that I’ve been gaming bounces off of will start to get sliced through with little to no reaction.

Again, definitely some more check marks for the bearish case yesterday & today but a little more work (key support breaks) to confidentially move to that “all in” or aggressive swing short positioning.