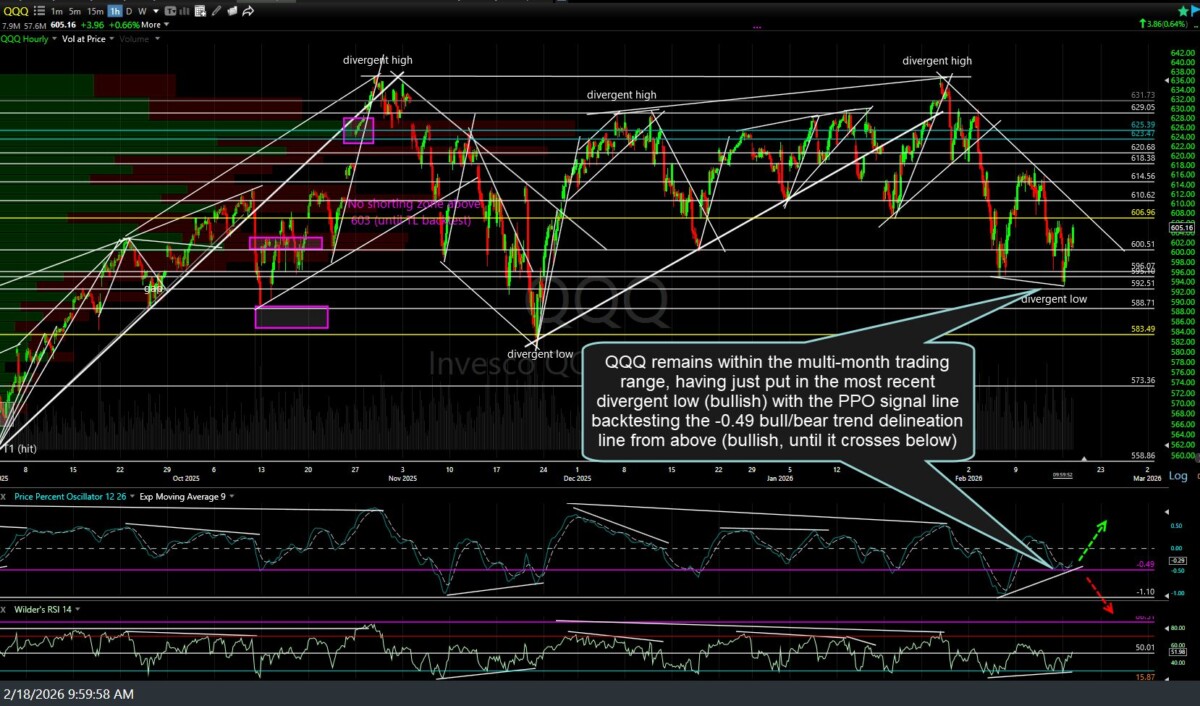

QQQ (Nasdaq 100 ETF) remains within the multi-month trading range, having just put in the most recent divergent low (bullish) with the PPO signal line backtesting the -0.49 bull/bear trend delineation line from above (bullish, until it crosses below). Still awaiting & favoring a downside break of the range (QQQ 589 support), which appears likely to happen sooner than later (this week or next, IMO).

As such, this bounce could get sold into just as it starts to get some traction, but until SPY & QQQ make definitive breakouts above or below these multi-month trading ranges, this is the market we have. Individual stock & sector selection remains much easier than trying to squeeze blood from this stone (swing trading QQQ or SPY for anything other than short-term trades lasting days or just a couple of weeks). 60-minute chart below.

/NQ (Nasdaq 100 futures) also continues to bounce around within the multi-month trading range, with short-term swing trades (long & short) following divergent highs & lows. 60-minute chart with current bounce target zone below.