$SOYB (continuous contract) is trading at the 948ish support level following a recent divergent low & extreme oversold reading. While there is a decent chance of a rally off this support level, the ideal scenario would be one last thrust down towards the 920ish support level and/or this trendline with one more divergent low before a substantial rally begins. We don’t always get a security to fall to our ideal buy point so while I favor the scenario outlined in the chart below, I will be on watch for signs of a potential reversal in soybeans around current levels in the coming sessions.

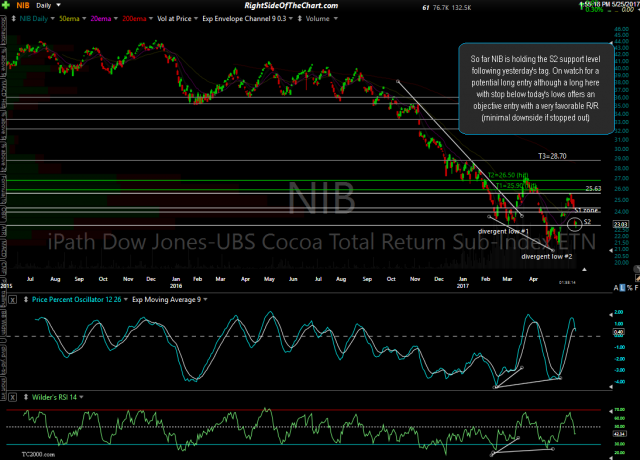

Looking at the daily chart of NIB (Cocoa ETN), I’ve watching the price action since NIB fell to the S2 support level yesterday (2nd chart below), waiting to see if that level held which, so far, it has. On watch for a potential long entry although a long here with stop below today’s lows offers an objective entry with a very favorable R/R (minimal downside if stopped out).

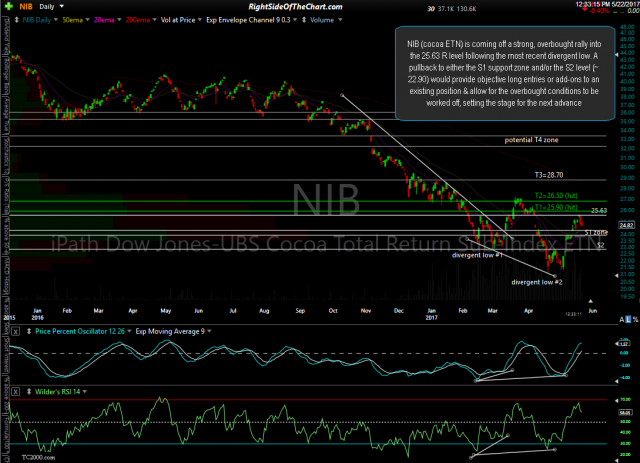

- NIB daily May 22nd

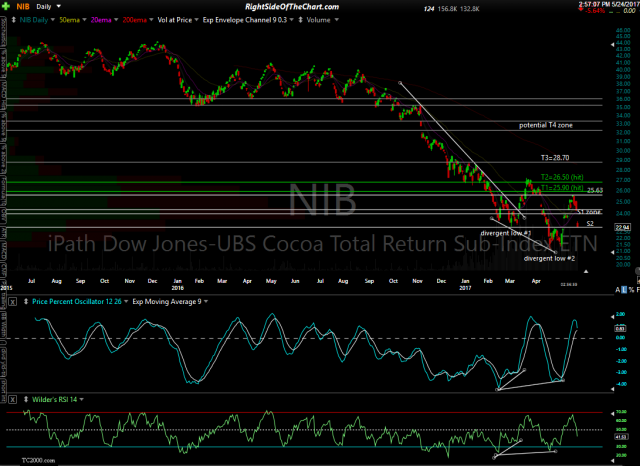

- NIB daily May 24th

- NIB daily May 25th