This can be considered a new swing trade idea, an objective add-on, or a re-entry to the previous objective entries (at support and/or on breakouts following divergent lows) and exits (at price targets/resistance with divergent highs). Regardless, UNG (natural gas ETN) offers an objective long entry on this pullback to the 12.62ish support and/or on a breakout above the downtrend line just above. Stops commensurate with one’s price target(s), which are denoted by the arrow breaks on the 60-minute chart below. Due to the inherently high volatility & above-average gain/loss potential on natural gas, my preference to to beta-adjust my position size down to about 0.3-0.5 (i.e.- 1/3rd to 1/2 of a typical position size).

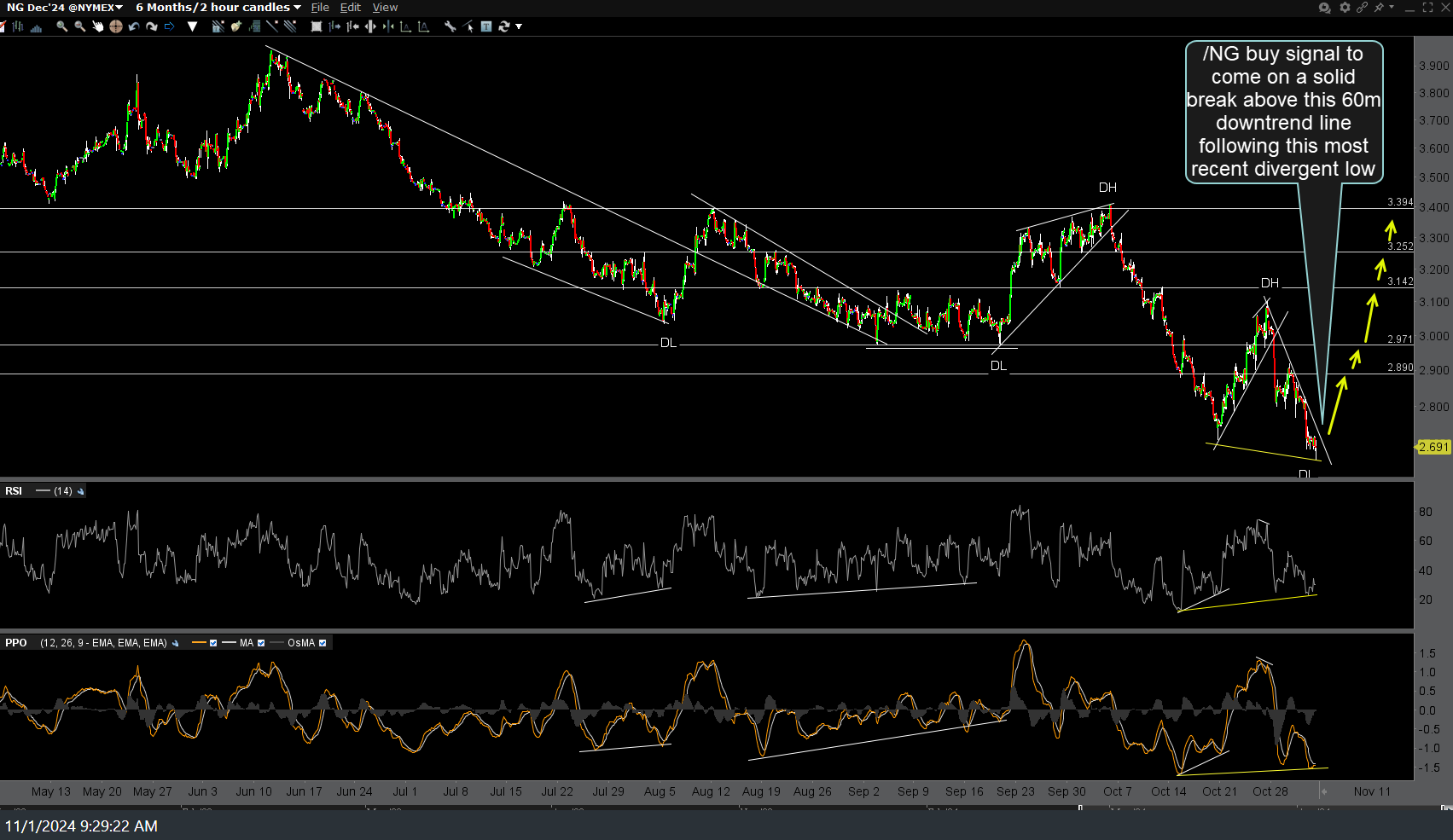

For futures traders, /NG buy signal to come on a solid break above this 60-minute downtrend line following this most recent divergent low.