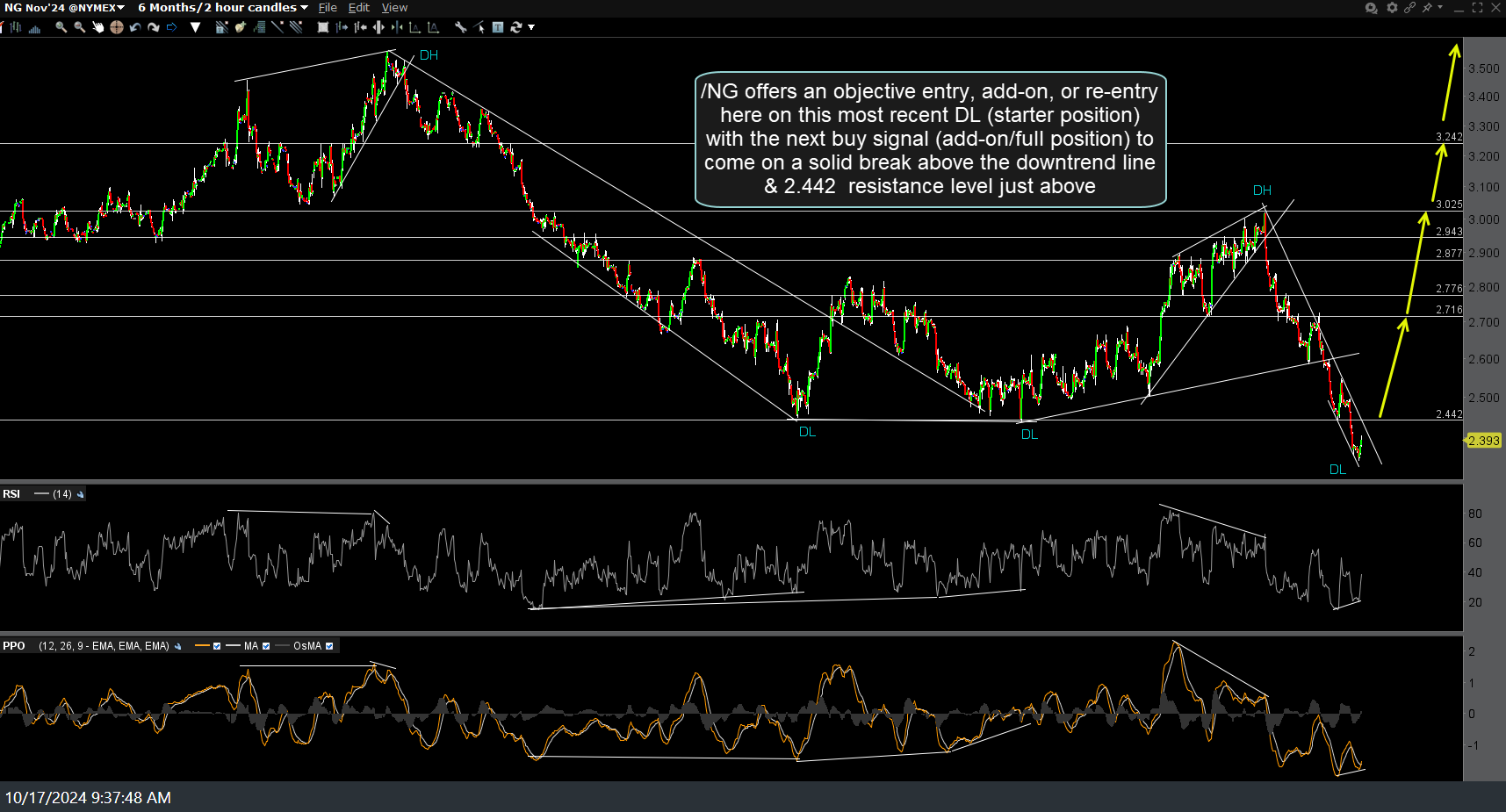

Although in yesterday’s video I stated, and still maintain, that the ideal re-entry, add-on, or new long entry on natural gas will come if/when /NG (nat gas futures) makes a solid recovery back above the 2.442 support it broke below yesterday, I now feel that /NG offers an objective entry, add-on, or re-entry here on this most recent DL (starter position) with the next buy signal (add-on/full position) to come on a solid break above the downtrend line & 2.442 resistance level just above. 120-minute chart below.

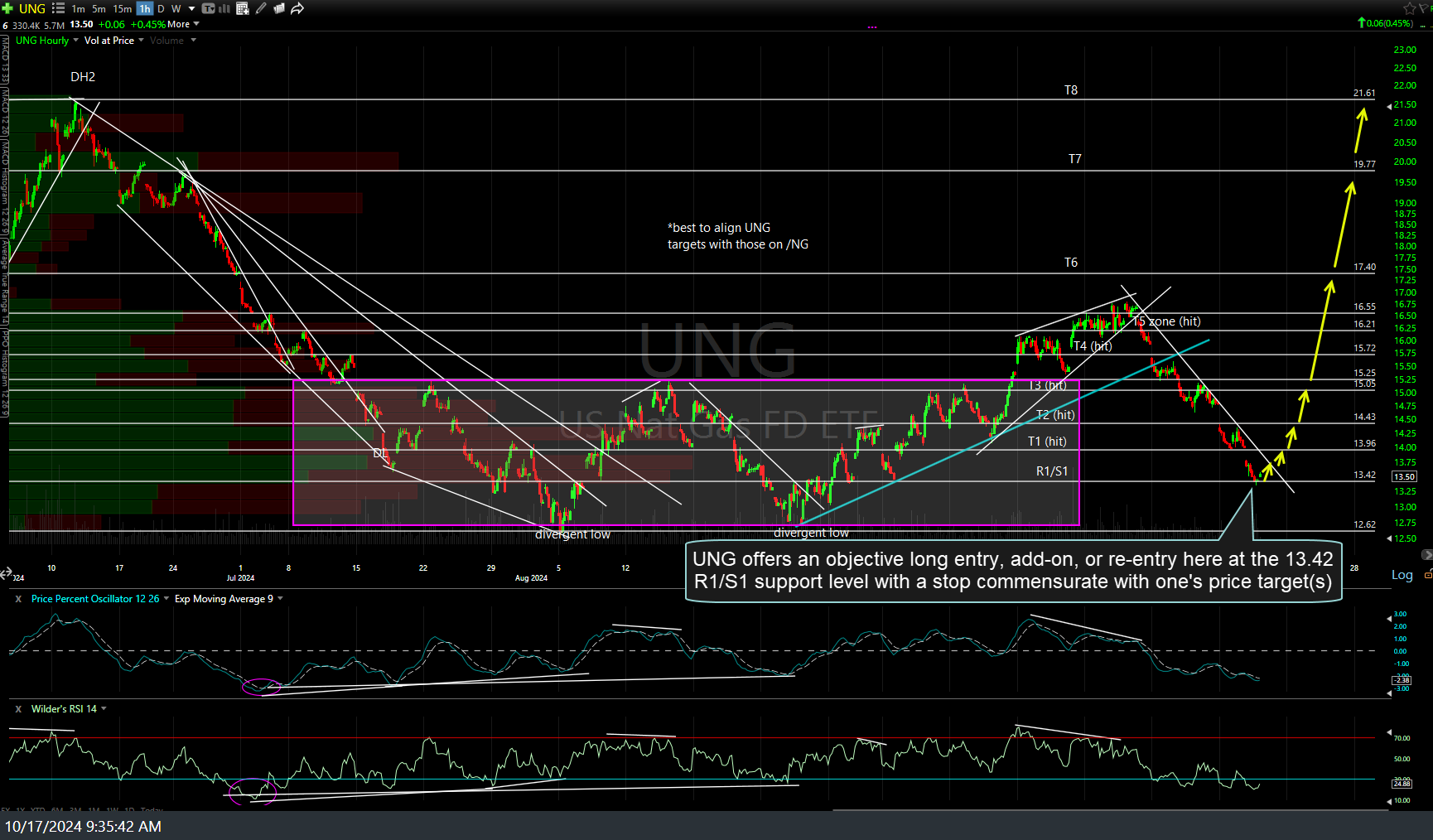

For ETF/ETN traders, UNG offers an objective long entry, add-on, or re-entry here at the 13.42 R1/S1 support level with a stop commensurate with one’s price target(s). Previous (Oct 7th, suggesting not to add/buy below the 15 level with a suggested stop below there although nat gas was also updated in several videos since) and updated 60-minute chart below.

NOTE: The weekly EIA nat gas report is scheduled for 10:30 am EST today & will almost certainly cause an immediate & sharp move in either direction.

As such, one could wait until that report is out of the way before taking a starter position, especially more risk-averse traders (who probably shouldn’t be trading this extremely volatile commodity anyway).