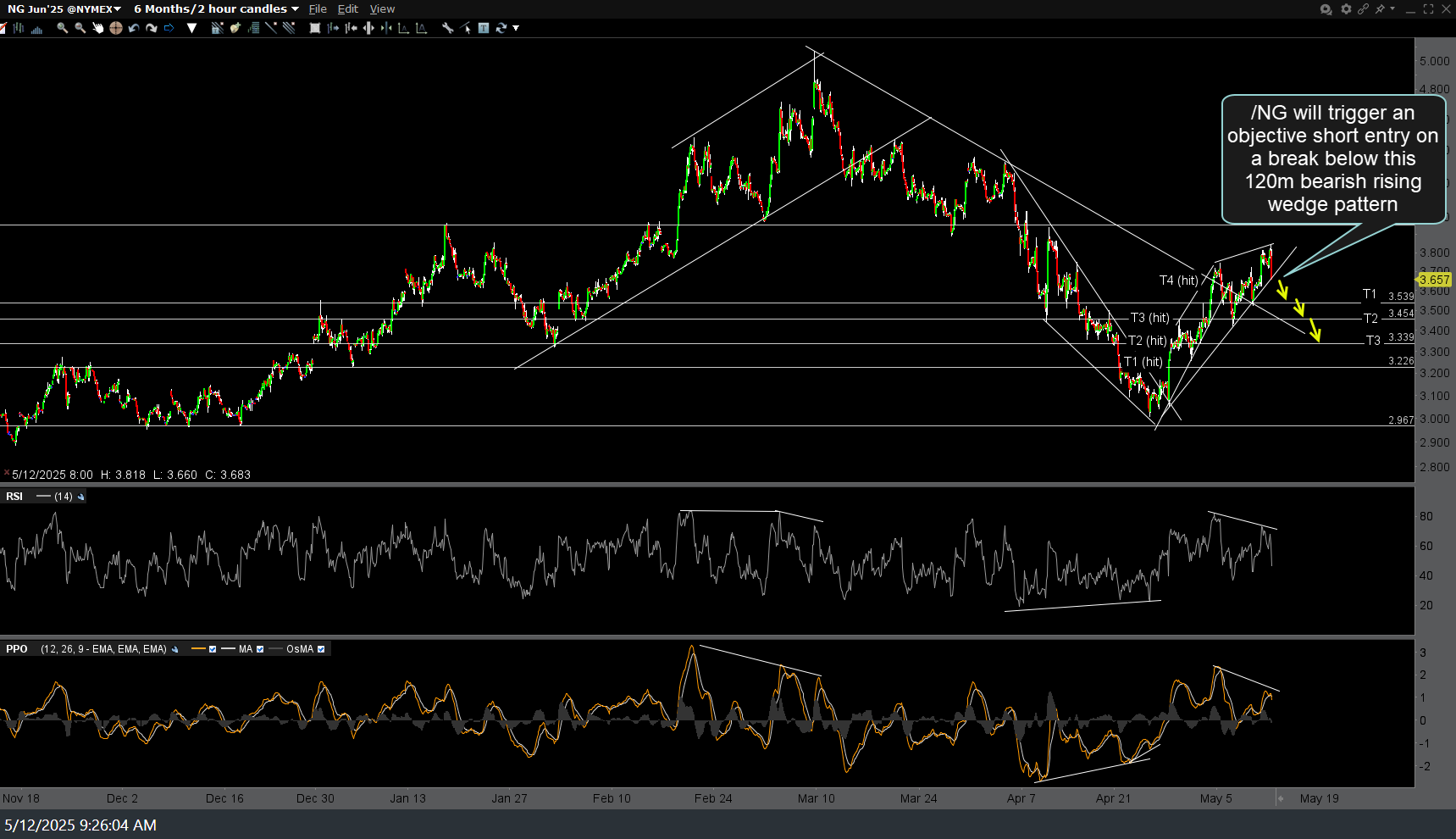

/NG (natural gas futures) will trigger an objective short entry on a break below this 120-minute bearish rising wedge pattern.

Alternatively, UNG (nat gas ETF) will trigger an objective short entry on a break below this 60-minute bearish rising wedge pattern.

No change in my outlook or trading plan for the Nasdaq 100. Looking for a nice fade of today’s gap up at the open but my plan remains to wait for a break of the recently highlighted uptrend lines on SPY & QQQ as well as the top indices & market-leading stocks as well as QQQ & SPY back below the 200-day SMA before adding to any swing shorts and/or waiting for QQQ to clearly start moving above the key 500 resistance level (including at least a 1.5% or better close above today) before starting to scale out.