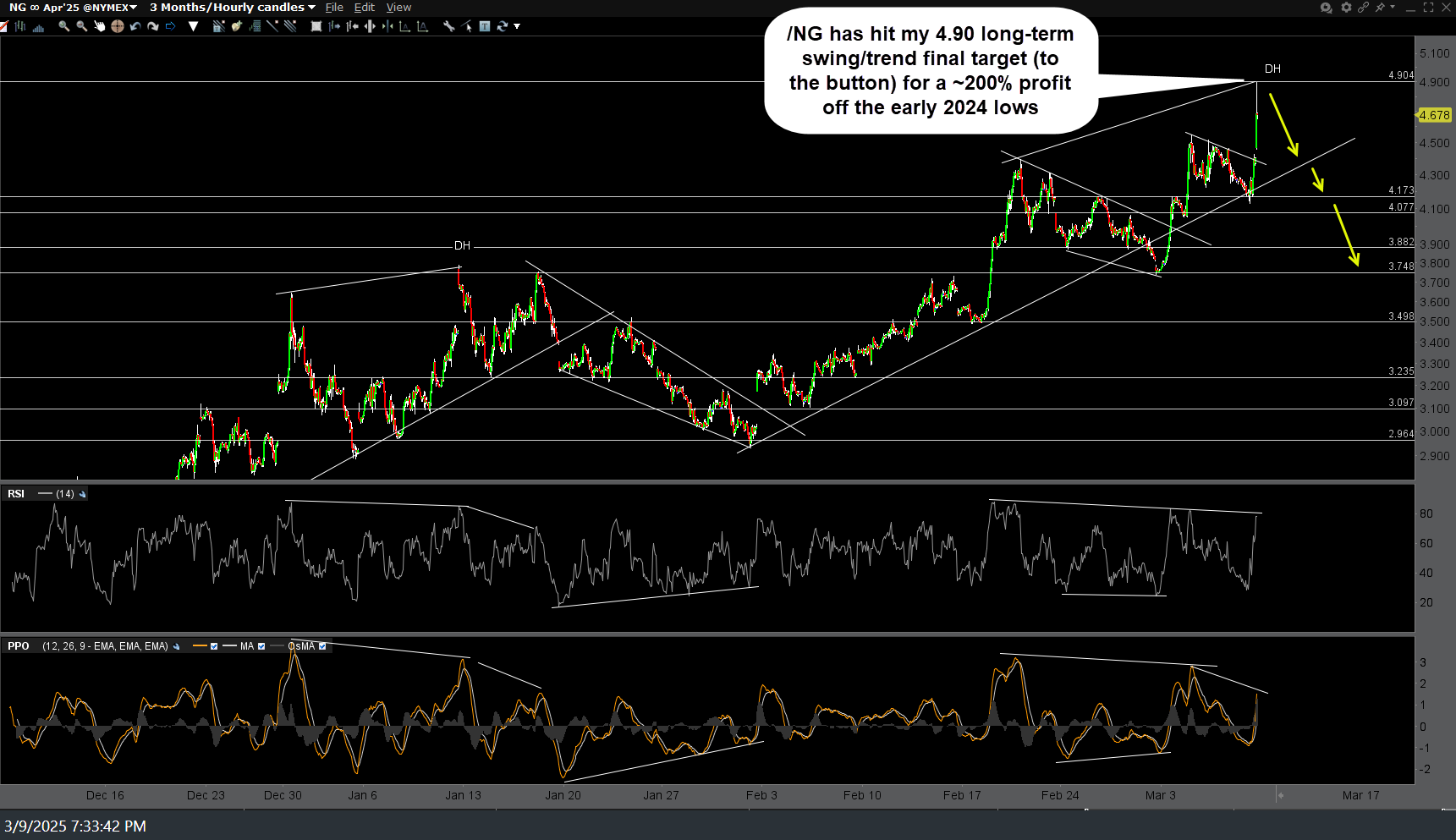

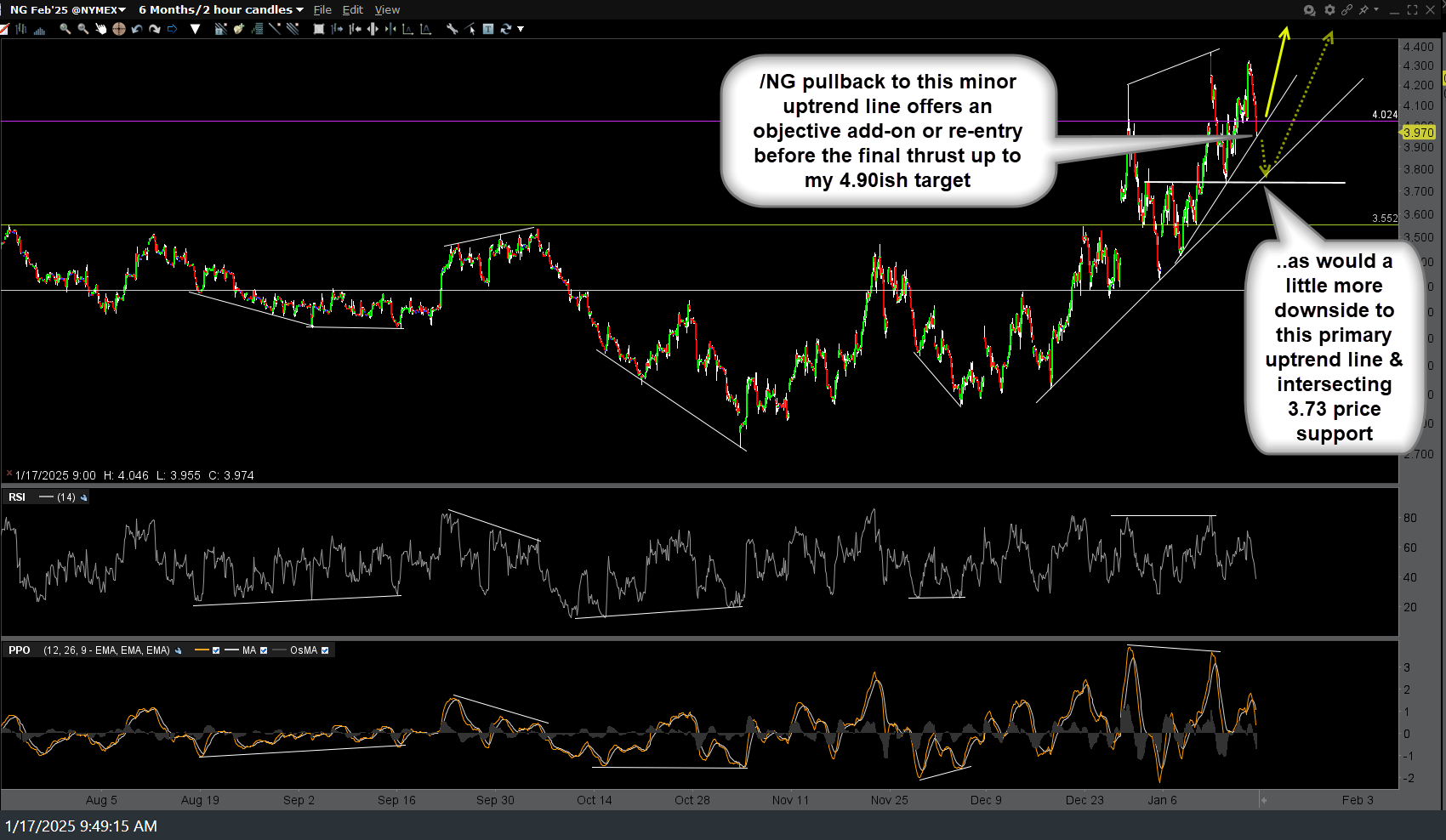

The /NG (natural gas futures) or UNG (natural gas ETN) long-term swing and trend trade, initially taken off the lows in early 2024, just hit my long-standing final price target of 4.90 (to the button) in the first trading session of the week after the futures opened for trading this evening (Sunday). Consider booking partial or full profits and/or raising stops if holding out for additional gains (I’m still open to nat gas ultimately running up to that additional potential target around 6.40 in the coming months) or reversing the trade (closing the long & shorting for a pullback and/or trend reversal trade, with stops somewhat above).

I’ve posted the updated 60-minute chart of /NG (nat gas futures, April/current contract) and $NATGAS (nat gas futures, continuous contract) above. However, keep in mind that the $NATGAS chart is an EOD (end-of-day) chart & therefore, only reflects the last candlestick as of Friday’s close. Some of the previous 120-minute charts of /NG & weekly charts of $NATGAS, going back to Feb 15, 2024, follow although the vast majority of the updates on natural gas were via trade ideas videos.