/NG (natural gas futures) still appears headed down to the 6.52ish support with reactions likely at the arrow breaks. 120-minute chart below (/NG will resume trading along with the stock futures at 6pm EST today).

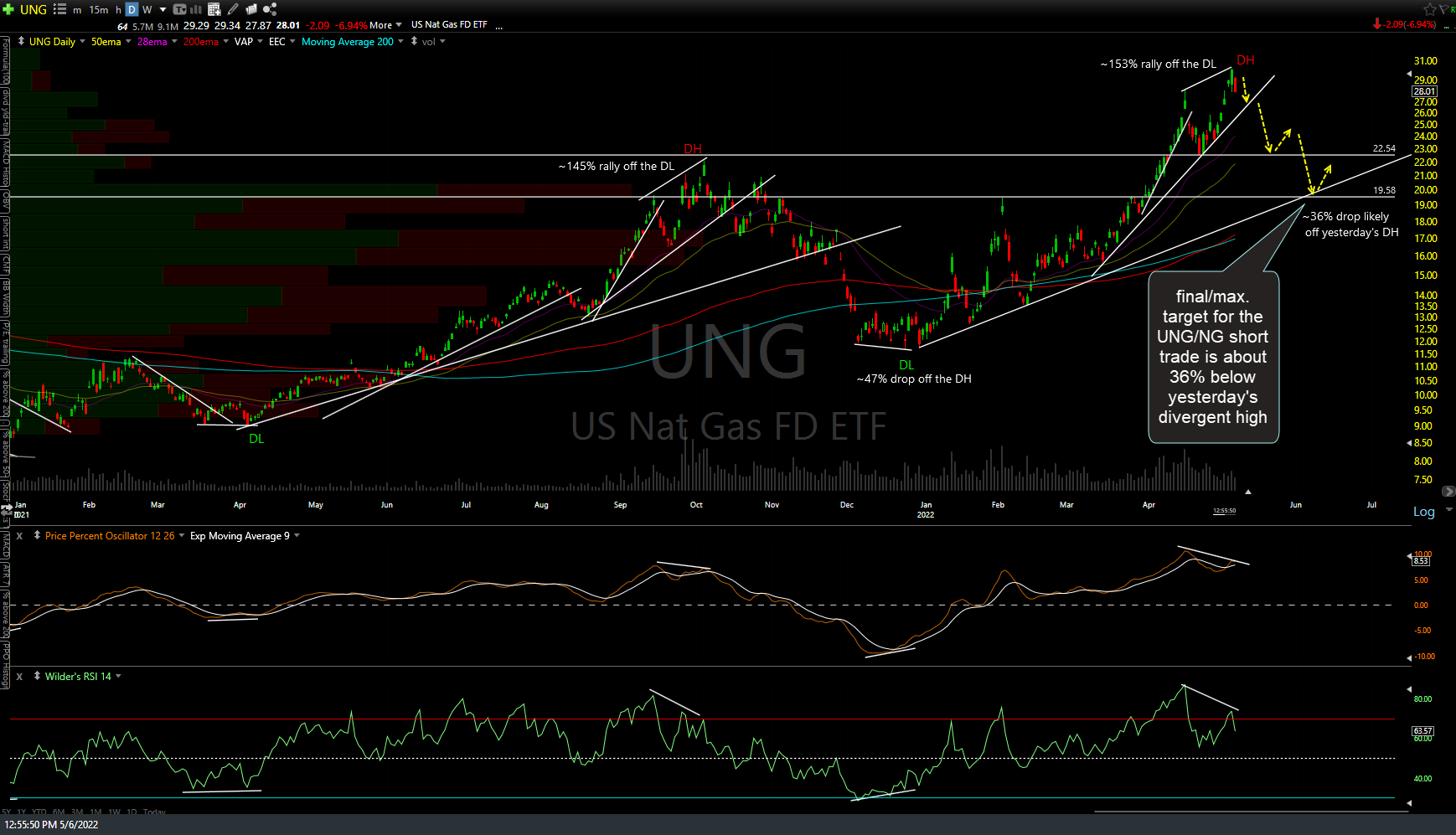

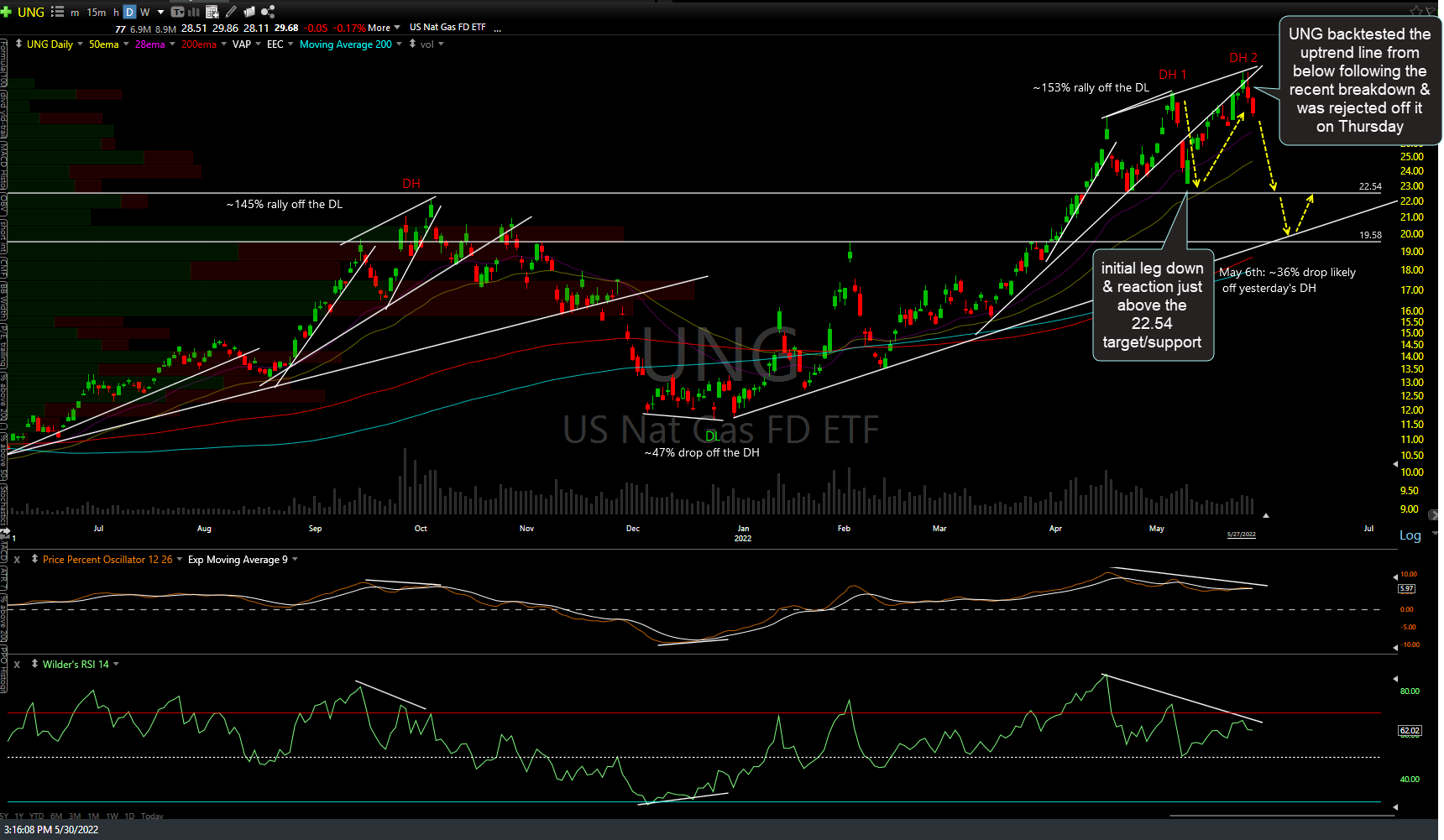

UNG (natural gas ETN) backtested the uptrend line from below following the recent breakdown & was rejected off it on Thursday & still appears to offer an objective short entry for another swing down to at least the 22.54ish support and quite likely the primary uptrend line and/or 19.58ish price support in the coming days to weeks. Previous UNG daily chart from the May 6th short entry followed by the updated daily chart.

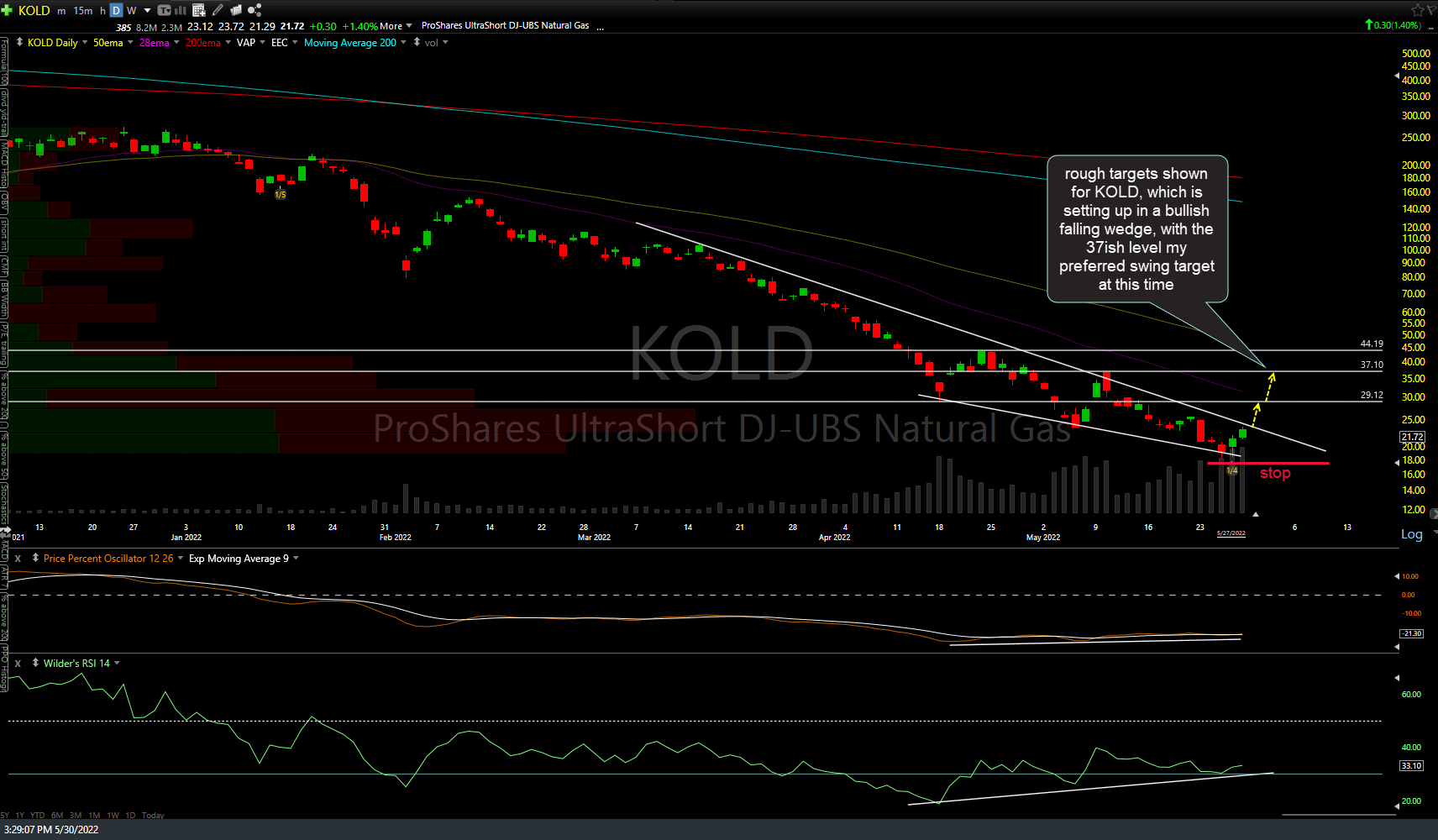

Additional proxies for trading natural gas are /QG (MINY nat gas futures), KOLD (-2x ETN), & BOIL (+2x ETN, which one could short instead of UNG in an attempt to capture the decay in addition to the price drip, should the trade pan out).

I’ve also included some “rough” targets for KOLD in the daily chart above although best to align any exits on a swing trade on KOLD with the target(s) on the charts of /NG as the 2x leverage coupled with the high-volatility of natural gas prices will distort the key levels on the charts over time.