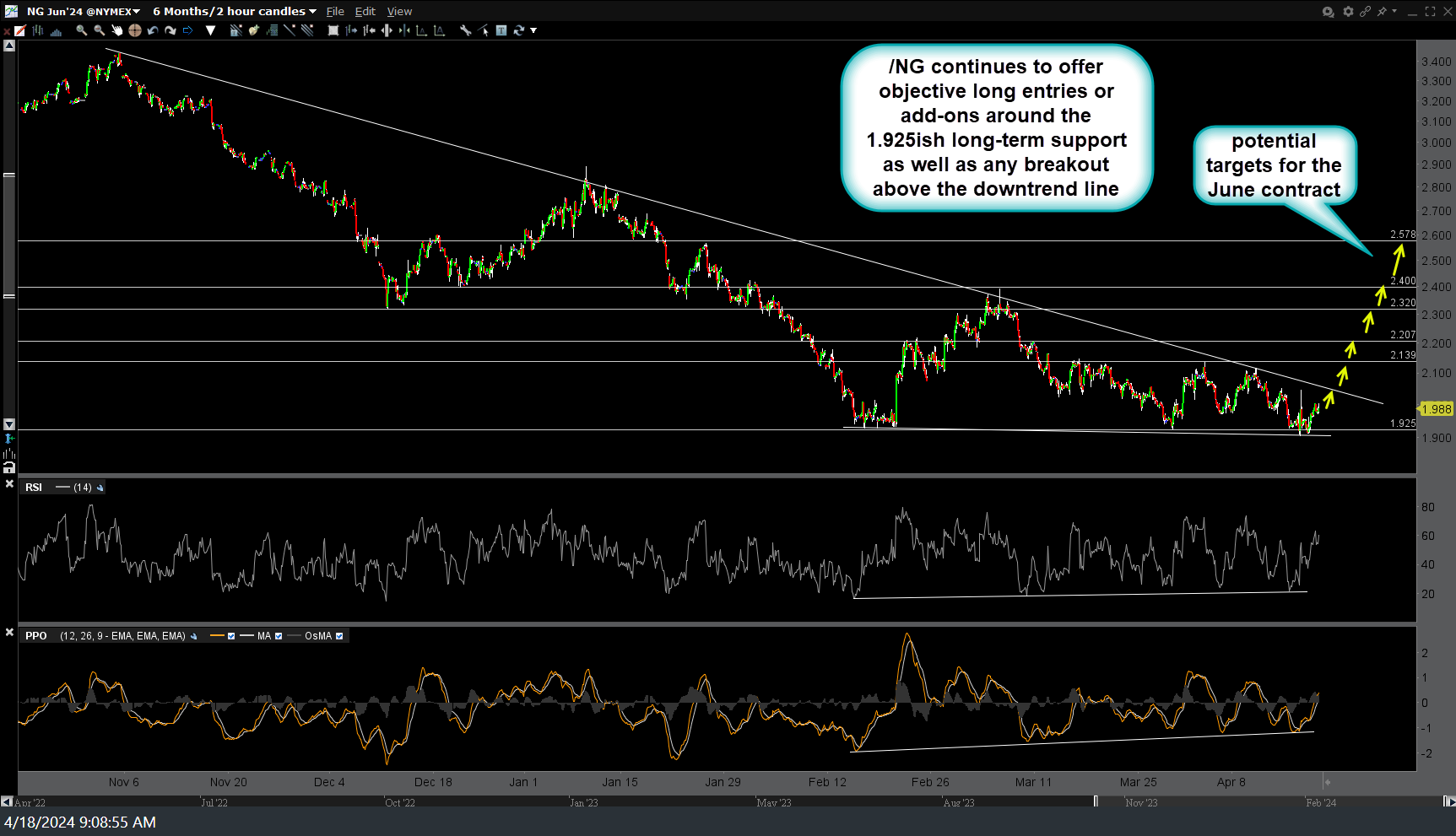

I just returned home from vacation & will do a deep dive into the charts asap to get some updates out later today or over the weekend but just wanted to fire this one off before the close for those in the natural gas trade. /NG (natural gas futures) has hit T5 (the final near-term* target) for a ~30%+ gain with potential negative divergences forming. Consider booking partial or full profits and/or raising stops if holding out for additional gains. April 18th (when we rolled to the June contract shortly after the initial entry in the previous contract) and the updated 120-minute chart below.

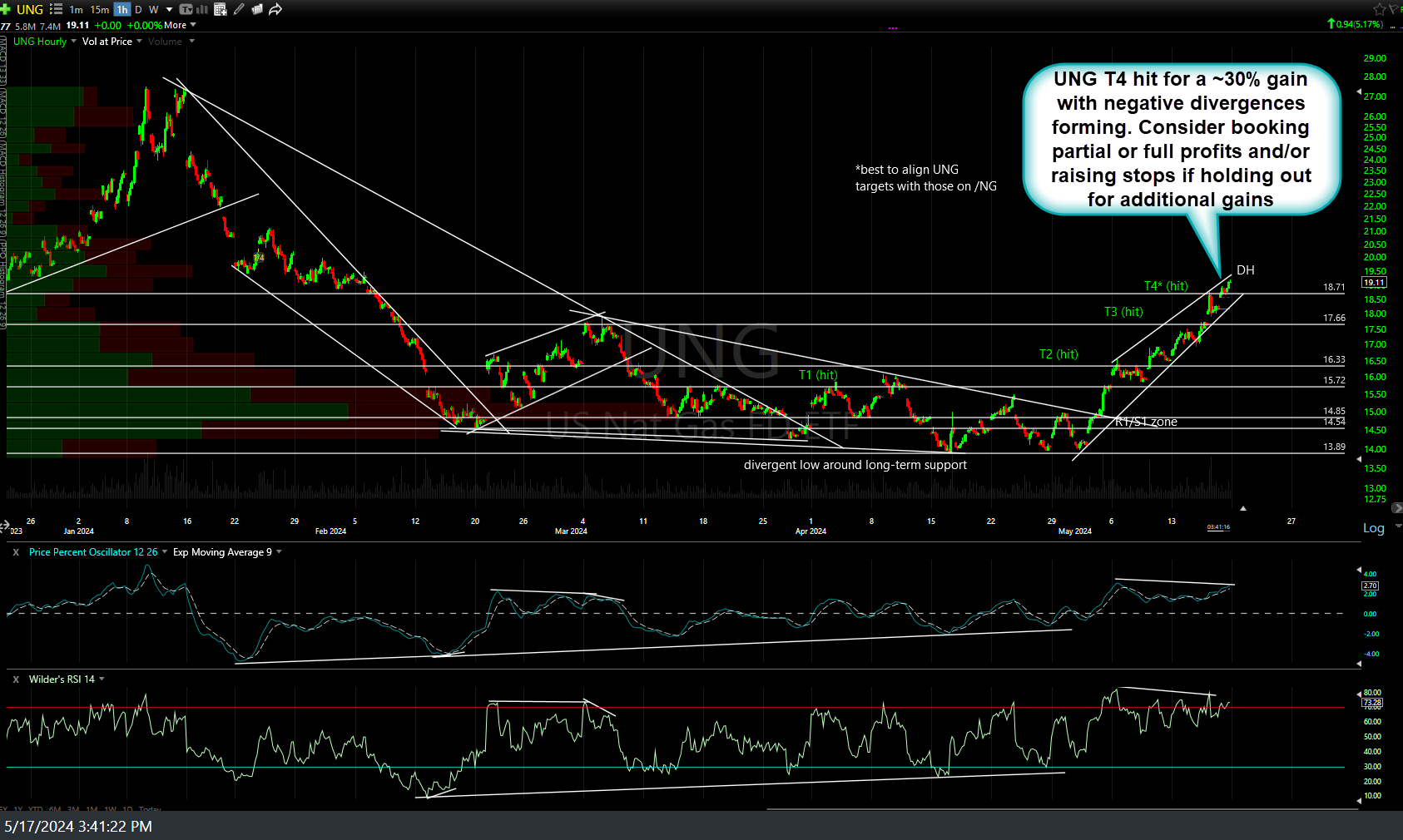

Likewise, UNG (nat gas ETN) has hit T4 for a ~30% gain with negative divergences forming. Consider booking partial or full profits and/or raising stops if holding out for additional gains. April 5th & updated 60-minute charts below.

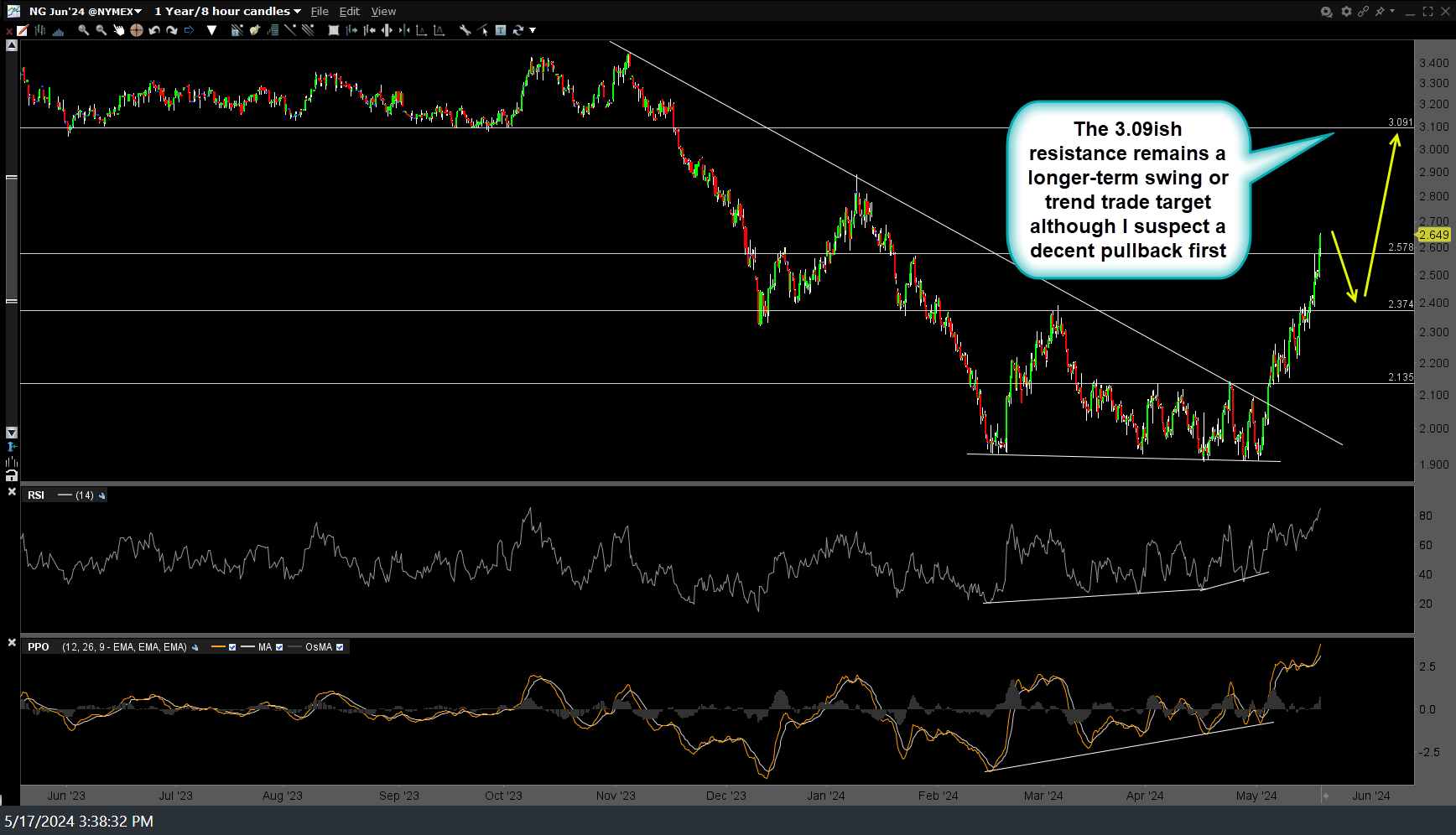

*As I covered in one of the videos last week before I went on vacation, the 3.09ish resistance remains a longer-term swing or trend trade target although I suspect a decent pullback first & will be closing out the typical swing trade here at the final targets on the 60 & 120-minute charts. Daily chart below.