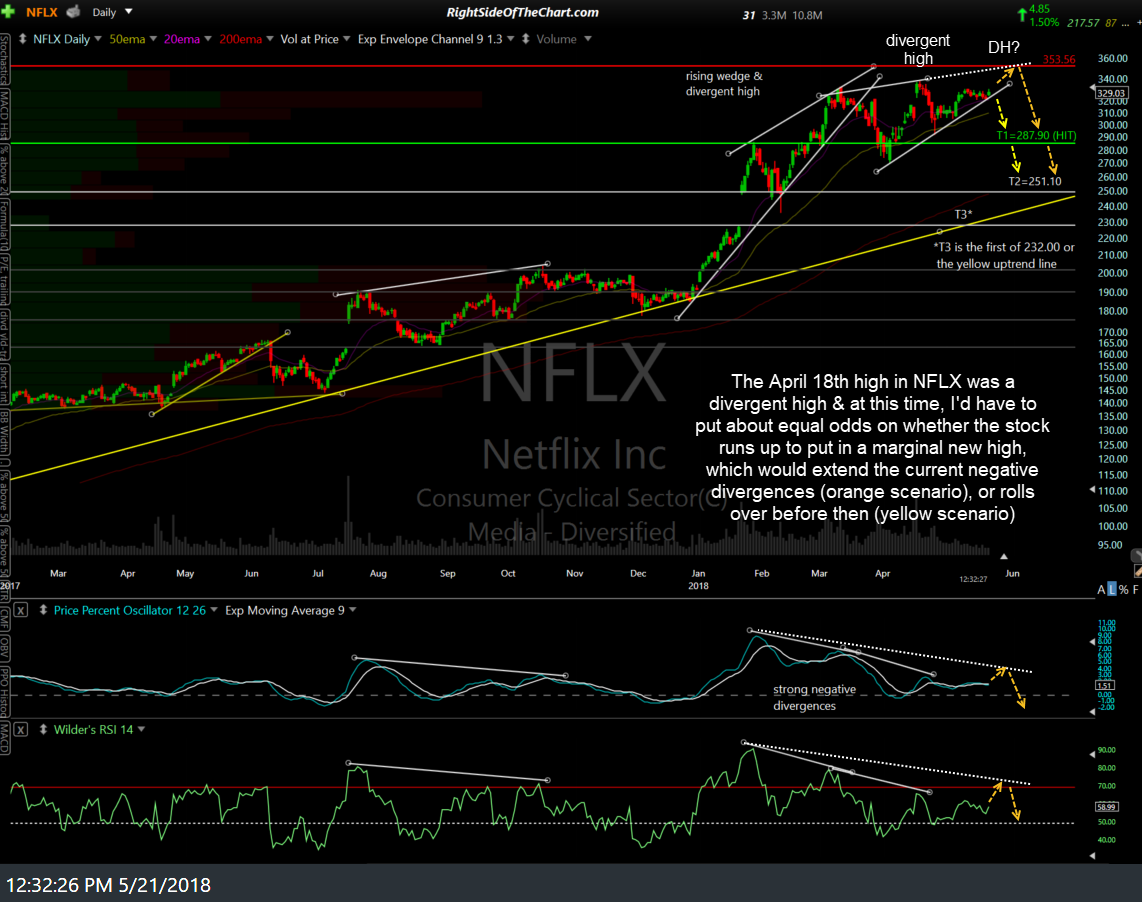

The April 18th high in NFLX (Netflix Inc) was a divergent high & at this time, I’d have to put about equal odds on whether the stock runs up to put in a marginal new high, which would extend the current negative divergences (orange scenario), or rolls over before then (yellow scenario).

Netflix is an active short trade which reversed shortly after hitting the first price target for an 11.1% gain on March 28th. While any marginal new high soon would extend the current divergences that were in place at the April 18th high, it would also bring the stock close to the maximum suggested stop of 353.56, which will remain the maximum suggested stop at this time.

A thrust up beyond that previous reaction high, followed by a reversal, would also firm up the potential bearish rising wedge that appears to be forming in this NFLX. Regardless, the uptrend line that forms the bottom of that potential wedge pattern is fairly well-defined & as such, an impulsive break and/or close below that level would provide the next objective short entry or add-on to an existing position.