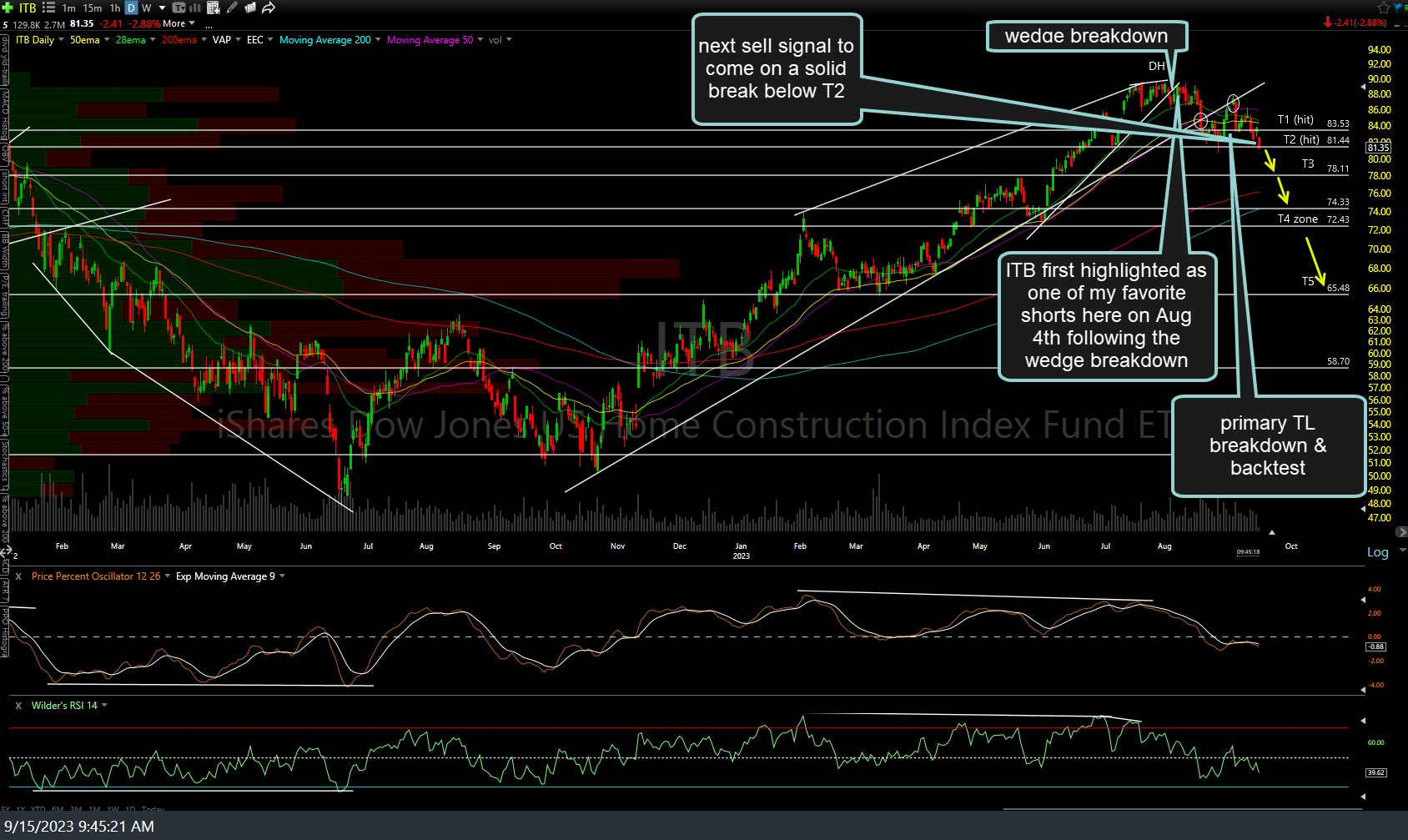

ITB (Home Construction Index Fund ETF) and the individual home builders stocks remain one of my favorite swing shorts at this time with the next sell signal to come on a solid break below T2 (the support level which ITB is currently trading at. (home builders first highlighted here on Aug 4th & in subsequent videos). Updated daily chart below.

On a somewhat related note, should my call for a substantial drop in the home building sector pan out, don’t underestimate the psychological effect a significant drop in the home builders could have on the housing market (existing home prices) as well as the stock market, as home valuations are one of the biggest drivers of consumer sentiment. One of the things worth watching at this time IMO, whether you are currently short the builders and/or related stocks or not.

Also, support is support until & unless broken so watch (and wait) for a solid break below today’s low in ITB as well as the other key support levels on the top components of ITB & XHB that I’ve highlighted in recent videos. The more of those that break support, the more likely the breakdowns in those sector ETFs are to stick.