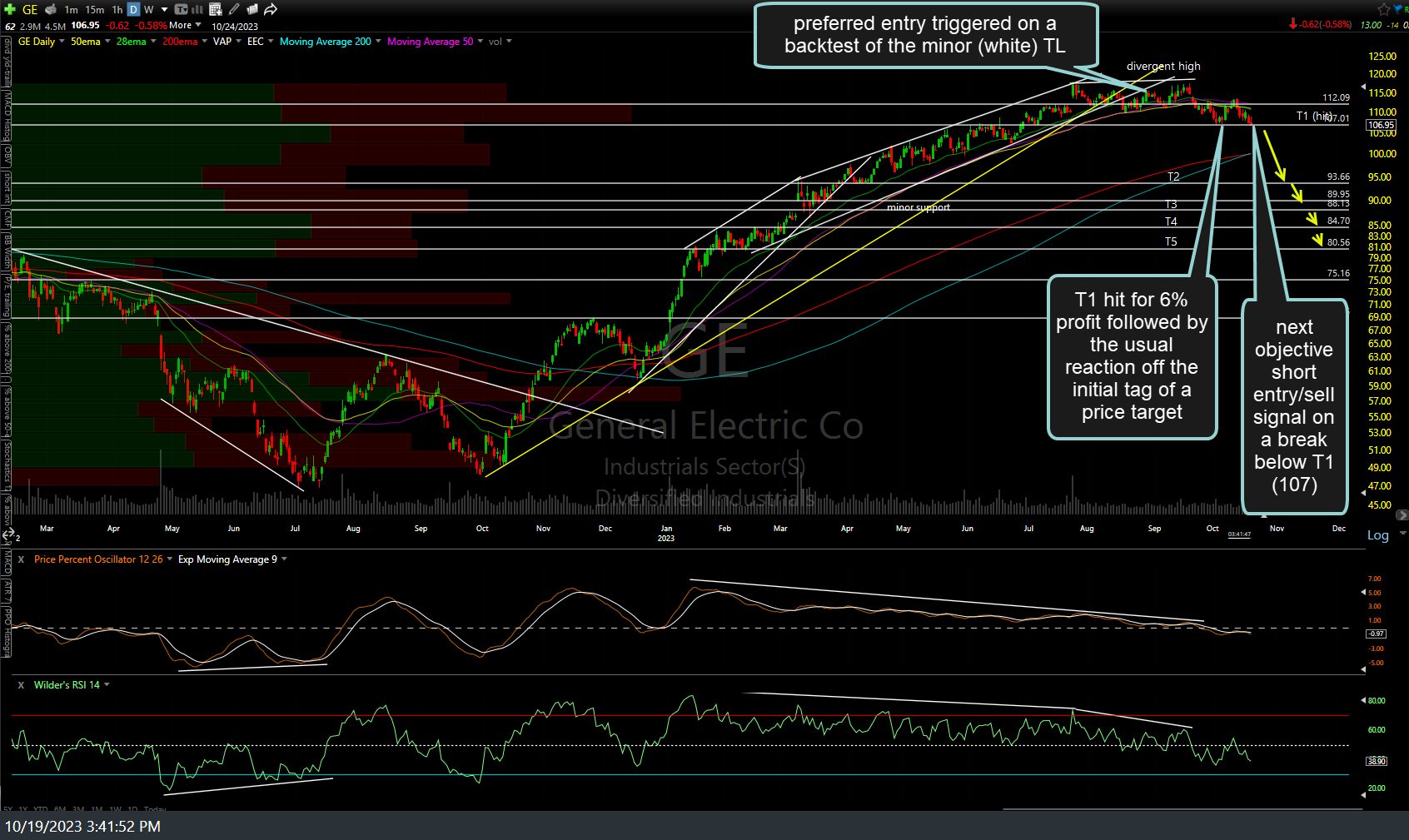

The GE (General Electric Co) short swing trade idea went on to mount the snap-back rally I was looking for, providing an objective short entry at a more favorable (higher) price shortly after the trade idea was first posted on two months ago on August 18th (first chart below).

Immediately following the backest (exactly as per the scenario arrows on that previous chart) GE went on T1 hit for a 7% profit followed by the usual reaction off the initial tag of a price target. GE is now testing that T1 (107) support once again & being that we already had the typical reaction off the initial tag of T1, the odds are elevated for a solid break and/or daily close below the 107 support & if/when that occurs, that will provide the next object short entry, re-entry, or add-on to an existing position. Updated daily chart below.