Shortly after 2pm ET, I posted in the trading room that I just closed out a good amount of long exposure and added additional exposure (via TQQQ & TNA shorts, QQQ puts and QID & TWM longs in non-margin/IRA accounts). That took me from a net long to net short exposure. The primary reasoning for the changes is based upon the fact that the US equity indices have run into key resistance levels while overbought on the near-term time frames with most longer-term & intermediate-term trend indicators still bearish.

Although anything is possible, by nearly all metrics it still appears likely that the US equity markets are in the early stages of a near bear market and with the recent frenzy-type buying of so many second & third tier, low-priced stocks (a dash-for-trash), the recent market action over the last few days is indicative of a late-stage bear market rally. As such, I believe that the R/R at this point is now skewed to the short side as the risk or a sudden & sharp reversal outweigh any probable upside potential in the equity markets before a meaningful correction.

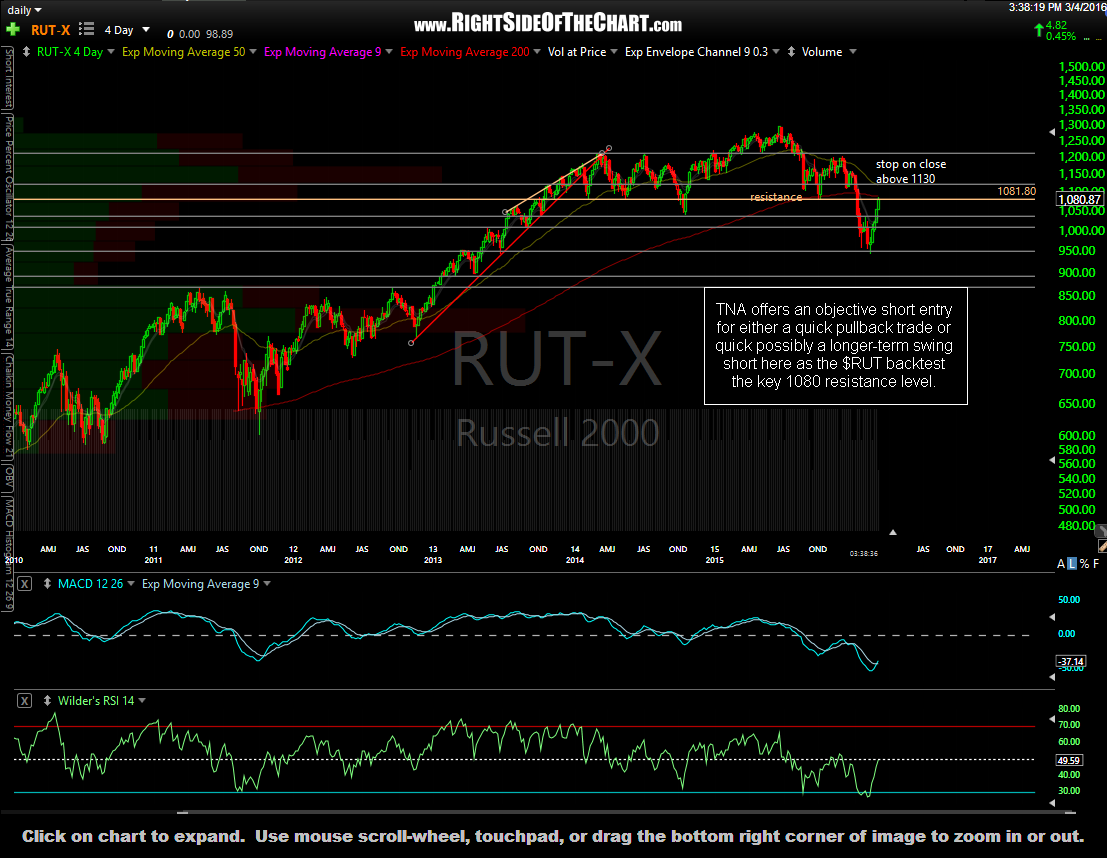

As mentioned earlier today, I plan to spend some time over the weekend reviewing the charts for the best looking individual stock & sector ETF trade setups, both long & short. However, should the market move lower or even sideways in the coming weeks, the $NDX (Nasdaq 100 Index) and $RUT (Russell 2000 Small Cap Index) will likely lead the way down. As such, TNA (3x bullish small cap ETF) will be added an an official short trade idea here (current price is 53.36) and should still offer an objective entry anywhere it trades up until the close today. TNA offers an objective short entry for either a quick pullback trade or quick possibly a longer-term swing short here as the $RUT backtest the key 1080 resistance level.

I will follow up with both near-term (pullback) and longer-term swing trade targets on this trade but just wanted to get it out before the close. As of now, the suggested stop for a swing position that might last weeks or months will be on a daily close above 1130 in the $RUT. For those unable to short TNA, TWM (2x short small cap ETF) would probably be a better choice vs. a TZA long if planning to hold for more than just a day or so.