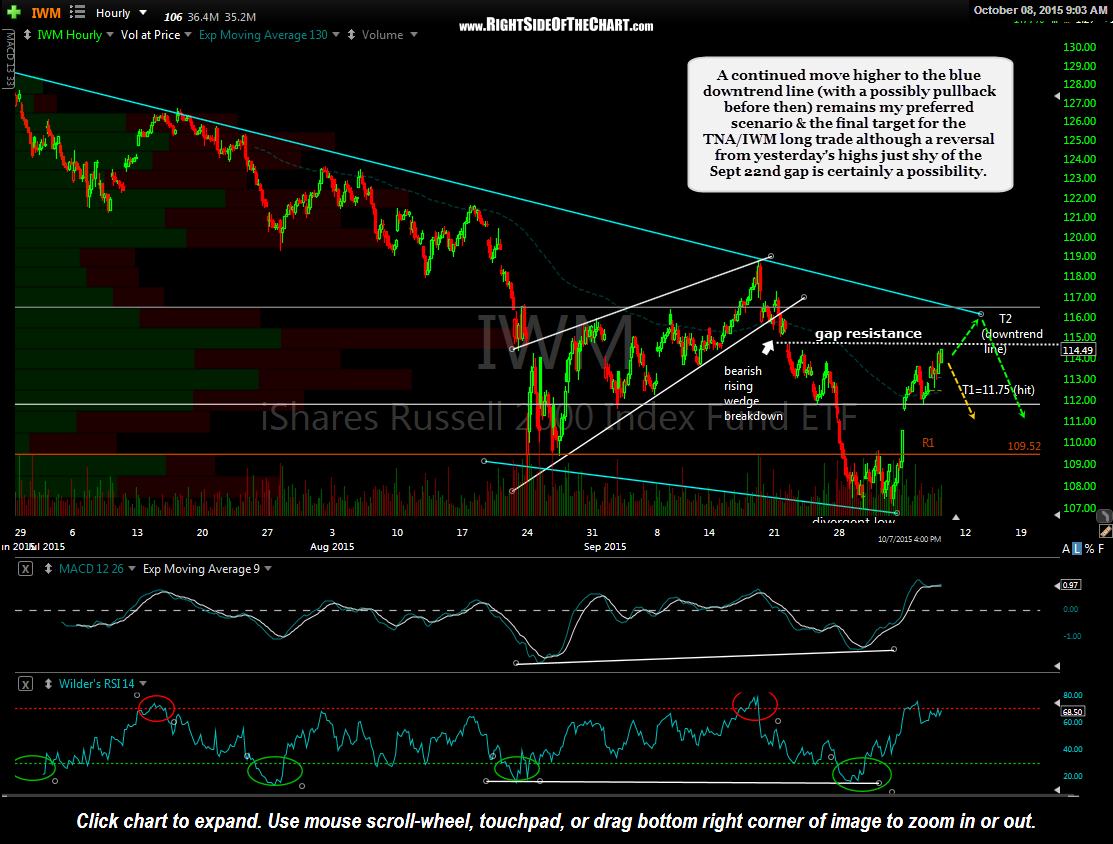

A continued move higher to the blue downtrend line (with a possibly pullback before then) remains my preferred scenario & the final target for the TNA/IWM long trade although a reversal from yesterday’s highs just shy of the Sept 22nd gap is certainly a possibility (orange arrow).

Taking a look at the $NDX 60-minute chart, My primary scenario (orange lines) is a major top is forming (with one more thrust up, which I’m leaning towards following today’s likely gap down) or has already formed with yesterday’s highs around the 4345 resistance level, which is also a Fib cluster. A slightly more bullish, alternative scenario would take the $NDX somewhat above the downtrend line before a reversal around the 4430 or 4487 levels (green lines).

My current trading plan & thoughts on the market are this: While the markets could certainly continue to rally for several more days or even weeks before the next meaningful leg down, by all accounts we are now approaching some very key resistance levels & Fibonacci retracements. As such, the R/R to continue to hold or add to long positions starts to rapidly diminish with each tick higher. Of course, that is unless the current overall bearish technical picture starts to morph back to bullish (i.e.- trend indicators flipping back to buy signals, key resistance levels taken out, etc…).

Although I might normally be looking to aggressively scale back into all my short positions (or new ones) that I recently closed out around the lows, I am going to wait until at least next week before deciding whether to begin moving back to a substantial net short position or not. I am still net long, including several of the recent trades ideas such as TNA, LABU & some individual stocks (including a starter position in the DAVE long setup, which I took before the close yesterday although that is still not yet an official Active Trade). As of now, I’m more concerned with lightening up my total exposure to the market and building cash, waiting for the next objective entry in the broad markets or any stand-out trade ideas.