Pardon the late start to the day following the 3-day weekend but RSOTC.com is back online now following an issue at the web-hosting server earlier today.

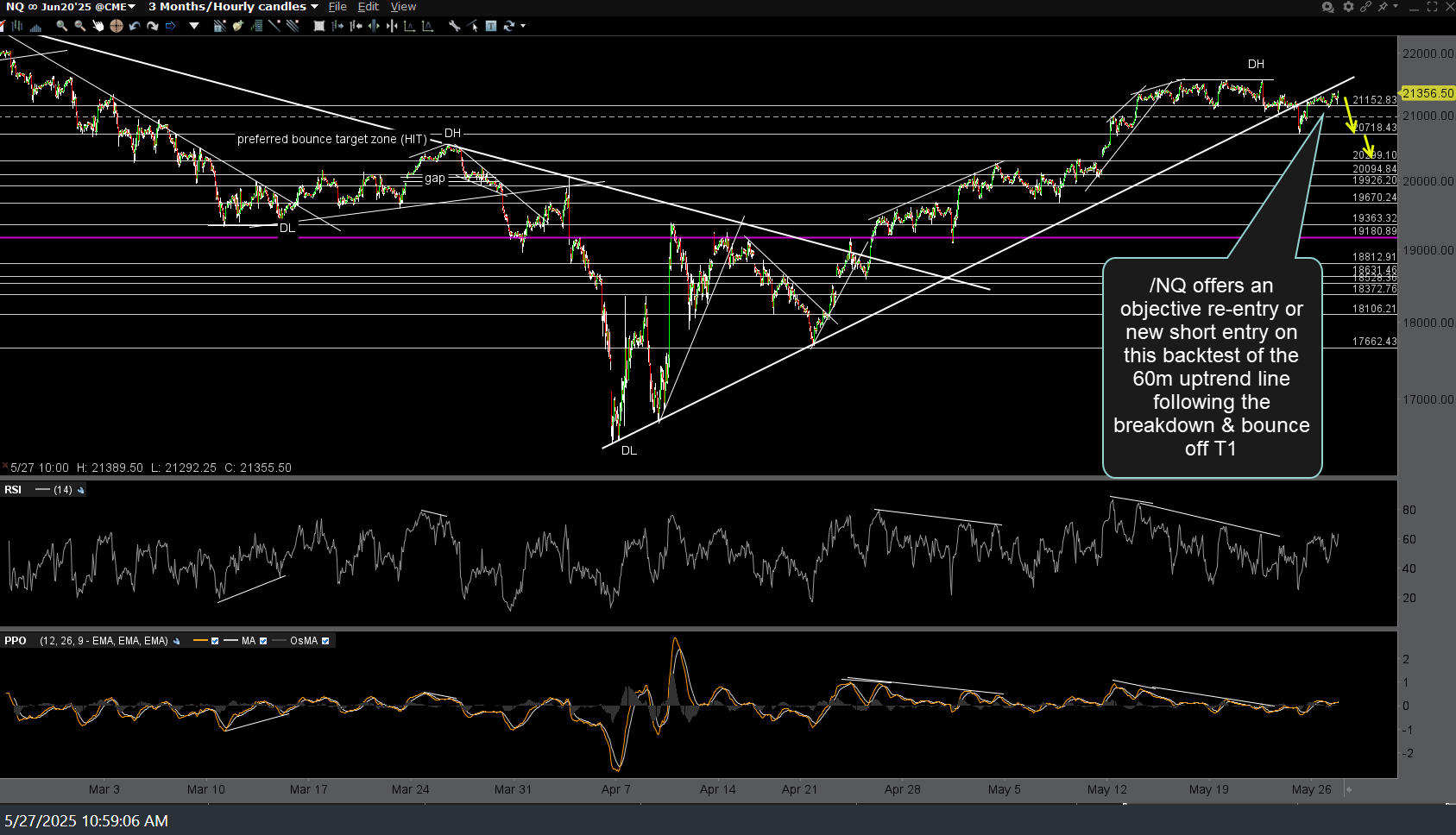

/NQ (Nasdaq 100 futures or QQQ) offers an objective re-entry or new short entry on this backtest of the 60-minute uptrend line following the breakdown & bounce off T1 & will continue to do so on any additional backtest as long as the negative divergences remain intact (and/or are extended on any marginal new high). 60-minute chart of /NQ below.

I’ve added two additional price targets added (T3 & T4) to the QQQ short-term swing trade whether the Q’s make a marginal new high soon or not. If so, stops would be commensurate with one’s average entry price & preferred target(s). e.g- For those that covered and/or reversed to long when T1 was hit last week & re-enter into another short position here or on a marginal new & still divergent high, a new stop would be above the previous stop of 532 that was based on the 522 entry price if targeting T2. 60-minute chart of QQQ below.

IWM (Russell 2000 Small-cap Index ETF or /RTY, futures) offers an objective re-entry or new short entry on this bounce off the 201.30 support and/or any additional tests of the primary downtrend line with stops somewhat above it. 60-minute chart of IWM below.

Longer-term swing/trend targets remain as previously posted on the weekly charts of QQQ & IWM.