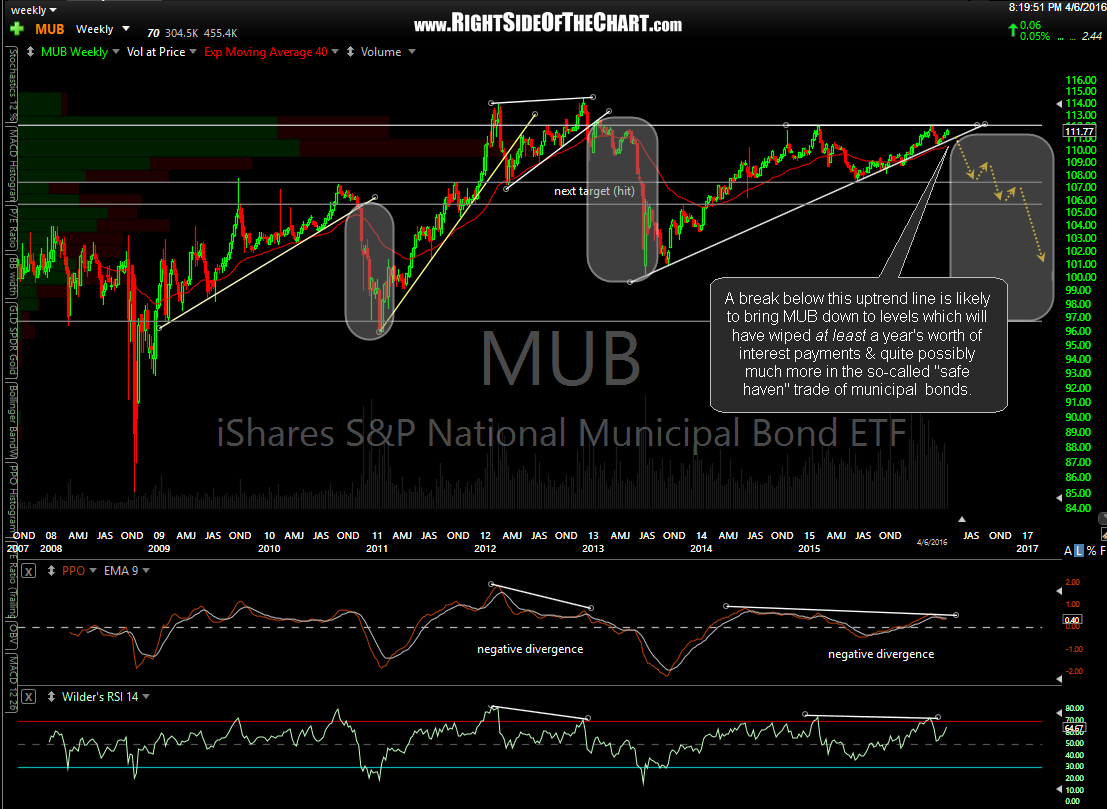

A break below this uptrend line is likely to bring MUB (iShares S&P National Municipal Bond ETF) down to levels which will have wiped at least a year’s worth of interest payments & quite possibly much more in the so-called “safe haven” trade of municipal bonds. This weekly chart shows that the technical setup for a substantial drop in municipal bond prices in the coming months+ is already in place & close to a resolution as prices are starting to pinch towards the apex of this ascending triangle pattern, all we need now is a spark/catalyst to light this fire & Puerto Rico might just provide it:

Puerto Rico enacts emergency debt moratorium bill (Reuters)

Puerto Rico Bonds Tumble on Debt Moratorium Bill (WSJ- might required a WSJ login)