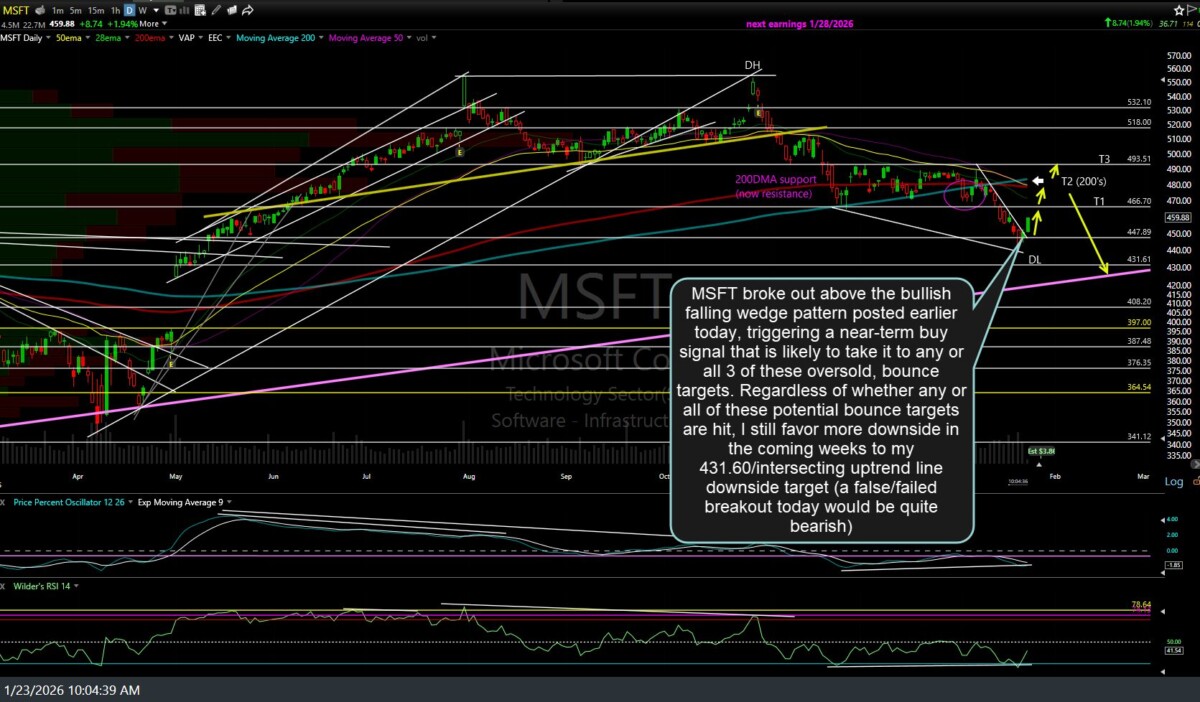

MSFT (Microsoft Inc.) broke out above the bullish falling wedge pattern posted earlier today, triggering a near-term buy signal that is likely to take it to any or all 3 of these oversold, bounce targets. Regardless of whether any or all of these potential bounce targets are hit, I still favor more downside in the coming weeks to my 431.60/intersecting uptrend line downside target (a false/failed breakout today would be quite bearish).

Based on the collective posture of the remaining Magnificent 8 stocks as well as the Nasdaq 100 and S&P 500 (both so far stopping at the afore-highlighted resistance levels/potential bounce targets/objective re-shorting levels), I suspect this breakout in MSFT will likely stop/reverse at or below the 200-day moving averages (T2 for the bounce trade). Those bullish could take MSFT as a pure-play long, with stops somewhat below the recent lows, targeting any one of these short-term, oversold rally/bounce targets as well as just letting the position ride while periodically raising stops, if expecting new highs in MSFT in the coming months.

Those bearish & currently short QQQ, /NQ, etc, could take a long position in MSFT as a partial hedge to that core short position (if the $NDX rallies from here, I suspect MSFT will outperform it, based on the fact it has one of the most bullish technical postures of the Mag 8 stocks). Either way, just passing it along for those interested. Previous & updated daily charts below.