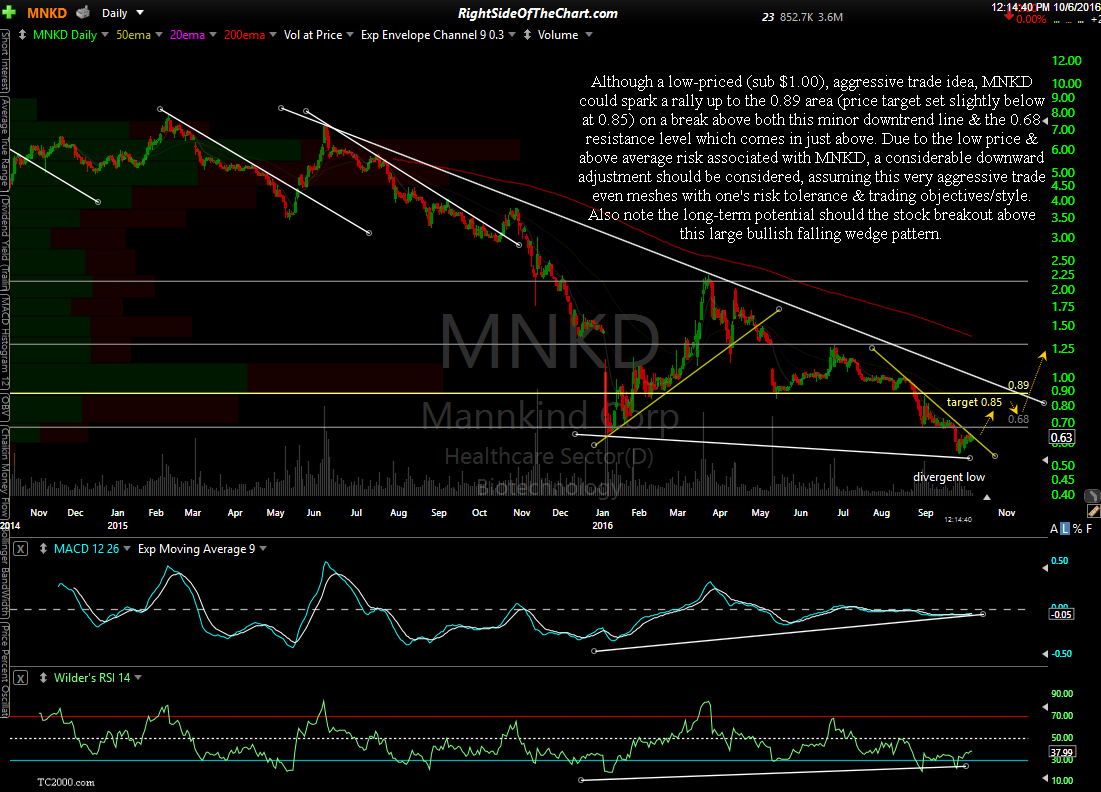

Although a low-priced (sub $1.00), aggressive trade idea, MNKD (Mannkind Corp) could spark a rally up to the 0.89 area (price target set slightly below at 0.85) on a break above both this minor downtrend line & the 0.68 resistance level which comes in just above. Due to the low price & above average risk associated with MNKD, a considerable downward adjustment should be considered, assuming this very aggressive trade even meshes with one’s risk tolerance & trading objectives/style. Also note the long-term potential should the stock breakout above this large bullish falling wedge pattern.

MNKD will trigger an entry on any move above 0.68 (ideally you want to see that occur on volume 1.5x or more above the 90-100 day average volume) with the sole price target of 0.85 for now. Additional targets might be added as this stock has a lot of potential if it can go on to break out above that large falling wedge pattern & regain the 1.00 level.

If an entry is triggered, the suggested stop will be on any move back below 0.64 and due to the very aggressive/high-risk nature of this trade as well as the potential for gains (24% if the target is hit) and loss if stopped out, the suggested beta-adjustment for this trade is 0.33, which equates to 1/3rd of a typical position size.