many of you are probably familiar with the terms “Max Pain” or “Options Pain”. not really anything you can trade by but it is sometimes worth noting when there is a large disparity between the current stock (or etf) price and it’s max pain value. however, don’t even pay these numbers any attention unless OpEx is only a day or so away as there is often a lot of shuffling around (squaring of positions) leading up to options expiration. again, take these numbers with a grain of salt but here are are few of key stocks or index tracking etf’s:

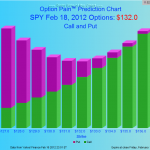

SPY closing price = 136.05, max pain = 132

QQQ closed at 63.62, max pain = 61

IWM closed at 82.80, max pain = 80

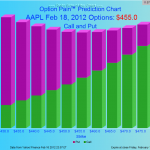

AAPL closed at 502.50, max pain = 455

all info and charts from www.optionpain.com

What is Option Pain?

In the option market, wealth transfer between option buyers and sellers is a zero-sum game. On option expiration days, the underlying stock price often moves toward a point that brings maximum loss to option buyers. This specific price, calculated based on all outstanding options in the market, is called Option Pain. Option Pain is a proxy for the stock price manipulation target by the option selling group.

How Should I Read the Option Total Chart?

Option Pain point is represented by the lowest bar in the chart. At this price, all the options in the market have the smallest dollar value.

How Should I Read the Call and Put Chart?

This chart plots the total value of calls (green) and puts (pink) separately. At a specific price point, if the call value is greater than the put value, the stock price may be manipulated below the strike price, making all call options worthless. If the put value is larger than the call value, the stock price may stop above the strike and make the put options worthless.

Does Option Pain Theory Really Work?

It has been observed over and over again that, near option expiration, option buyers suffer significant losses. According to a New York Times article, it is likely that option sellers, including firm proprietary traders, “manipulate stock prices by selling large numbers of shares whose prices they wanted to keep from rising and by buying other shares whose prices they wanted to support.”