I’ve been busy with some non-trading related issue today and just getting online for the day. Last night I had started drafting some ideas to do a video covering various trend determining indicators and hope to wrap that up to share this afternoon, if possible. The bottom line is that for now, the short-term trend in the market (as measured by the $SPX) remains down although by most metrics that I use, the trend will revert back to a buy signal (up trend) should the market move much higher from where it so far peaked today. A very simple but effective method that I use to determine the intermediate term trend, the 20 & 50 ema pair, is also very close to triggering a sell signal but has yet to do so. Therefore, I believe how the market performs this week could likely help determine we we’re headed over the next few weeks & possible months.

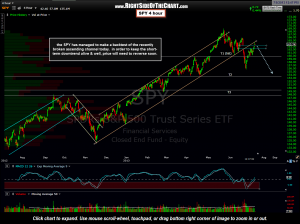

Until then, here’s the updated 4 hour chart of the SPY. So far today prices made a perfect kiss of the recently broken ascending channel which was the most optimistic of my bounce targets. Although prices often make additional backtests at higher levels before reversing, which is still a possibility, any move over the June 18th intraday high 165.99 will call into question the downtrend that has been firmly intact since the market peaked back on May 22nd. More on that in the video which should be out later today.

Until then, here’s the updated 4 hour chart of the SPY. So far today prices made a perfect kiss of the recently broken ascending channel which was the most optimistic of my bounce targets. Although prices often make additional backtests at higher levels before reversing, which is still a possibility, any move over the June 18th intraday high 165.99 will call into question the downtrend that has been firmly intact since the market peaked back on May 22nd. More on that in the video which should be out later today.