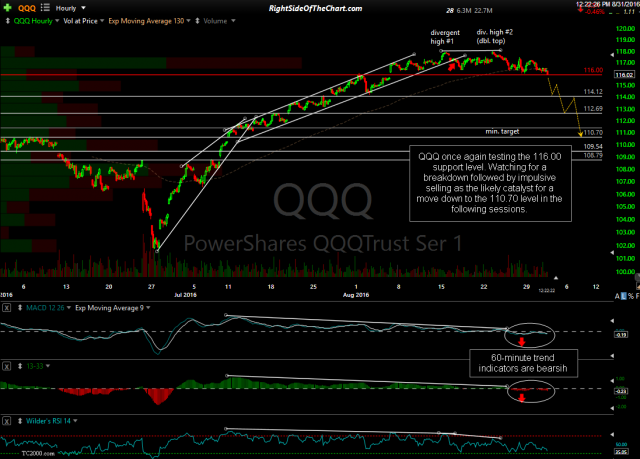

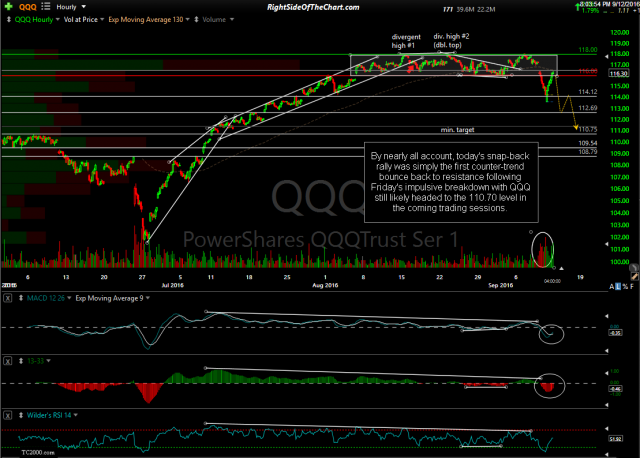

This video is really longer than it needs to be as the gist of what covered is the fact that despite the stock market’s impressive recovery to print a strong close after gapping down at the open today, I don’t see anything in the charts that indicate that today’s rally was anything more than the expected snap-back rally following a very brief & minor overshoot of the first support level on QQQ (as anticipated all the way back on Sept 1st in the first 60-minute chart below).

- QQQ 60-minute Aug 31st

- QQQ 60-minute Sept 12th close

Should the market manage to continue to build on today’s gains going forward, only a solid 60-minute close above the top of Friday’s gap (117.23) would begin to call the bearish scenario into question. QQQ stopped at 116.49 today, 2 cents shy of the bottom of Friday’s gap (resistance) and a penny below the top of the optimal short entry/add-on zone that I posted before the market opened today, offering what will likely prove to be the most objective & timely short entries in months, possibly years or a very small loss for those that stuck with their trading plan & took advantage of this bounce back to resistance & very objective shorting opportunity, if stopped out.