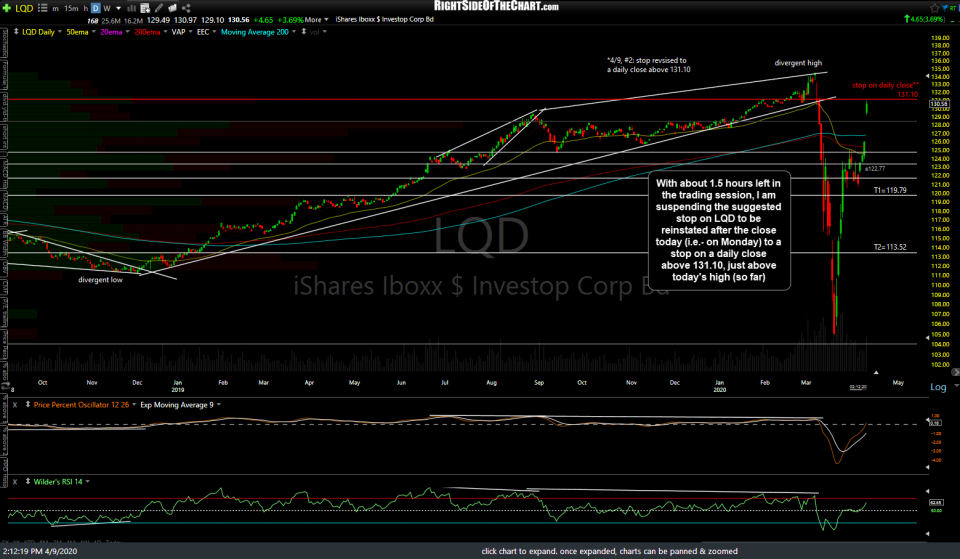

After revising the suggested stop on the LQD Active Short Trade earlier to daily close above 126.51 (the previous stop level was based on any intraday move up to that level), I am revising the stop once more to a daily close above 131.10 with that stop to be reinstated on Monday (i.e.-after the close today, regardless of where LQD trades today).

My logic on today’s stop revisions is this: Had I left the stop as-is on any move above 126.51, that would have entailed any standing BTC (buy-to-cover) stop-loss orders as 126.51 to be converted into market orders at today’s open (as stop-loss orders are converted to a market order once the stop price is hit or exceeded). That would have seen those orders queued in line with the surge of buy orders (both stops on shorts plus long-side buy orders) at the open where the order imbalances (too many buy orders vs. sell orders) would have seen those stops filled anywhere from the opening price of 129.49 up to the initial opening spike of high of 130.63 shortly after the market opened & the order imbalances subsided.

As I type (2.22 pm EST), LQD is trading at 130.54, so right around where a GTC stop-loss order coming into the open today would have been filled. Since it does not appear likely that LQD will close below the previously revised stop of 126.51 today, I could either close the trade out here or at the close today for a guaranteed loss of roughly 6.4% –or– set a stop just above today’s highs, in which point I risk losing not much more that I am already down on paper today yet, I leave the door open for the possibility that today’s move in LQD was an overreaction caused by too many short positions & traders being caught off guard by the Fed’s surprise announcement of $2.3T in lending facilities to shore up the credit markets. Should that be the case (the nearly 4% gain in LQD proves to be a one-day overreaction due to a large number of positions being caught off guard, triggering a short-covering rally) with all of today’s gains & then some being faded in the coming weeks, that would leave open the possibility of recouping today’s loss on the trade & quite possibly going on to hit one or both profit targets in the coming weeks to months. Essentially, I am willing to risk a relatively small amount of additional losses (<1%) in order to leave open the potential for 10x or more in gains.

While suspending a stop as well as basing a stop on a daily closing basis does open up the potential for additional losses, my convictions are very strong that any upside in LQD from here is extremely limited. From a fundamental basis, should the outlook for the economy improve going forward, that should be a net negative for LQD as rising growth expectations would correlate to rising interest rates. Other than the recent plunge in investment-grade corporate bonds which was solely driven by a rapid shift in expectations of a massive downgrade in the credit quality of the corp. bond market, particularly the dangerously large lower-tier of BBB rated bonds, the price investment-grade corporate bonds are inversely correlated with interest rates; rates up = bond prices down & vice versa.

On the flip side, should expectations of future growth in the economy deteriorate going forward, I believe that any measures by the Fed to prop up the bond market will be overwhelmed by selling as the bond market is larger than the stock market & just too big for the Fed to control, other than causing short-term rallies with surprise announcements like they did today, by sticking a few fingers in the cracks of a massive dam full of leaks.

Bottom line: Both the technical & fundamental reasoning behind the current LQD short trade, as well as the two previous & profitable short trades that were closed out over the past couple of months, are still very much intact. As always, use stops & take trades that mesh with your own comfort level, outlook for the security, & risk tolerance while passing on trades that don’t.