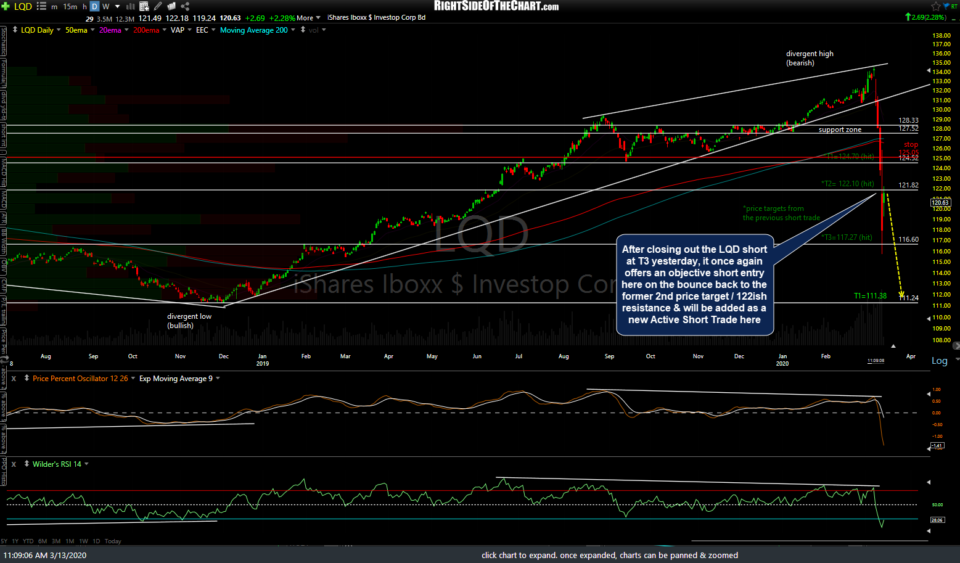

After closing out the LQD (investment-grade corporate bond ETF) short at T3 for a quick 22% beta-adjusted gain yesterday, it once again offers an objective short entry here on this bounce back to the former 2nd price target / 122ish resistance & will be added as a new Active Short Trade here around the 120.63 level.

The sole price target at this time is T1 at 111.38, set just above the bottom of the multi-year trading range that I’ve highlighted in recent videos (weekly chart below). The suggested stop for this trade is 125.05. As with the previous trade, due to the (normally) inherently low volatility of corporate bonds, the suggested beta-adjusted position size for this trade is 2.0.

Should LQD happen to take out the 122ish resistance & push higher, it will still offer an objective short entry or add-on up to but not above the 124.52 former support, now resistance level in which the first target on the previous trade was set just above.