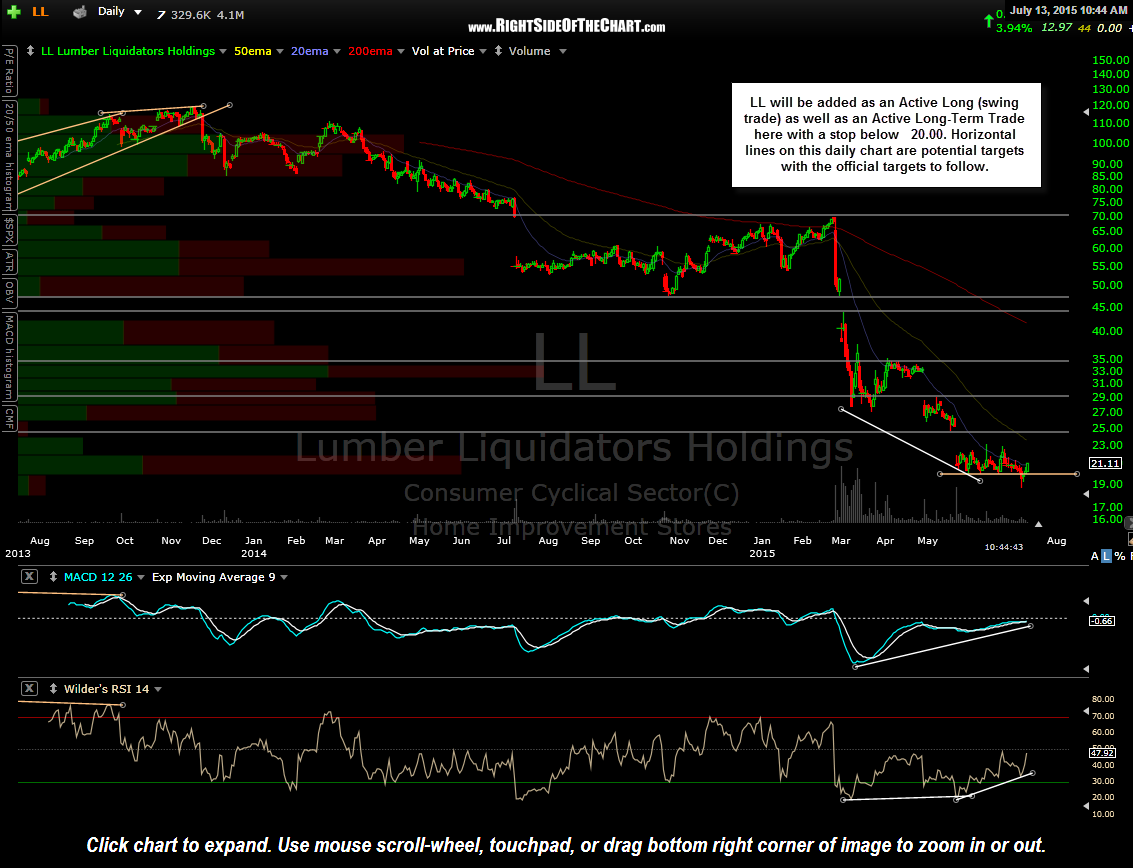

LL (Lumber Liquidators Holdings) will be added as an Active Long (swing trade) as well as an Active Long-Term Trade here with a stop below 20.00. Horizontal lines on this daily chart are potential targets with the official targets to follow.

On the daily time frame, LL has bullish divergences in place on both the MACD & RSI. This stock has numerous overhead gaps which are likely to be backfilled & act as potential targets, should this trade start to pan out. Numerous reactions around the 20.00 level over the last couple of months make that an idea support level in which to place a relatively tight stop-loss, thereby providing an excellent R/R to any of the potential overhead target levels. Again, specific suggested sell limit targets will be provided later, should LL start to move higher from here with the first target roughly at the 24.00 level.