LL (Lumber Liquidators Holdings) is a good example of technical analysis and bad example of hastily determining stop levels while rushing to post a new trade idea.

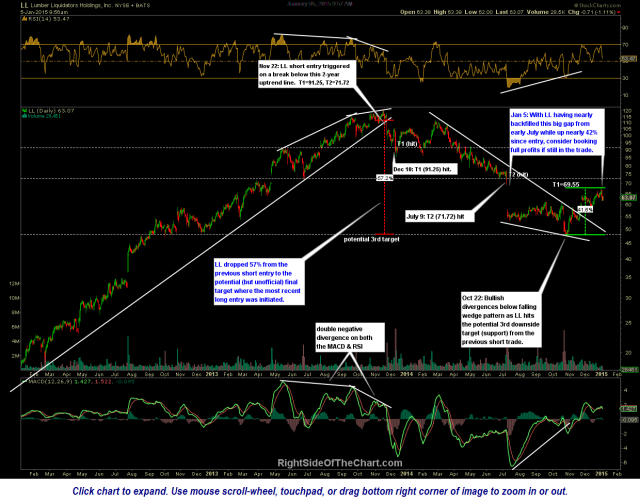

The Good: LL was first posted as a short trade idea back on Nov 22nd with an aggressive entry around 114 or a more conservative entry on a break below 109. From there, the stock proceeded to plunge nearly 60% to the potential 3rd & final target. By the time I received an alert that T2 (the official final target at the time) it was too late to extend the final target to T3 as most standing buy-to-cover orders would have already been filled. From there I watched the stock and waited until the T3 level was hit at which time I had also been monitoring the development of a bullish falling wedge pattern, complete with strong bullish divergences in place on both the MACD & RSI (as highlighted in the previous post).

The Bad: In my haste to mock-up the chart, compose my notes & post the trade idea in asap, I quickly made the decision to use an overly aggressive stop of 48.60 which was essentially right on or only slightly below the actual support/reversal level that I was originally targeting for the third and final potential target on the previous short trade. As such, this trade slightly exceeded the previously suggested stop criteria. This overly aggressive stop provided a very attractive 6.5:1 R/R (risk-to-return ratio) to the stated preferred target of 69.55 but again, the stop should have been placed low enough to provide a slight overshoot of support (something very common when a stock approaches a support level during a strong downtrend).

The take away from this is two-fold: 1) Suggested stops and profit targets are just that; suggestions. Always trade according to your own personal risk tolerance & stop parameters. 2) For those still long LL, consider booking full profits or at least raising stops as prices are now just below the bottom of the July 9th-10th gap where LL is most likely to find considerable resistance, especially as the stock has gained about 41% since the long entry from Oct 22nd. As such, LL was be considered a completed trade (technically, stopped out for a loss due to the previously stated suggested stop criteria). Congratulations to those that allow a more reasonable stop buffer & were able to capitalize on this trade.