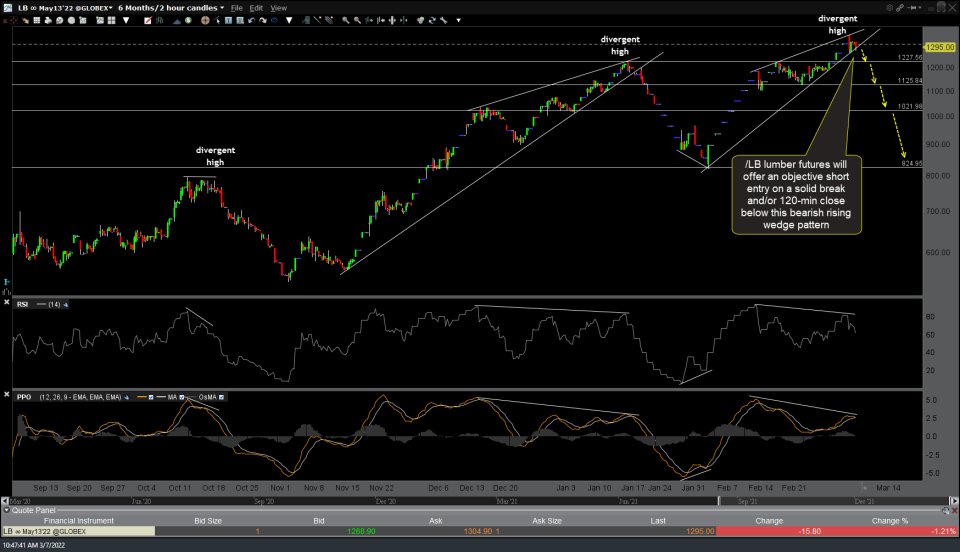

/LB (lumber futures) will offer an objective short entry on a solid break and/or 120-minute candlestick close below this bearish rising wedge pattern. 120-minute chart with potential (and unadjusted) price targets below.

FYI- To the best of my knowledge, there aren’t any ETFs or ETNs that directly track lumber prices. The closest proxy would be WOOD & CUT, which are ETFs that hold a basket of timber & forestry stocks.

Also, I just wrapped up a video covering the stock market, gold, silver, financial sector, & semiconductors sector along with comments regarding crude oil, wheat, palladium, fertilizer stocks, & other securities that are directly impacted by the Russia/Ukraine situation. That video is uploading now & should be posted shortly.