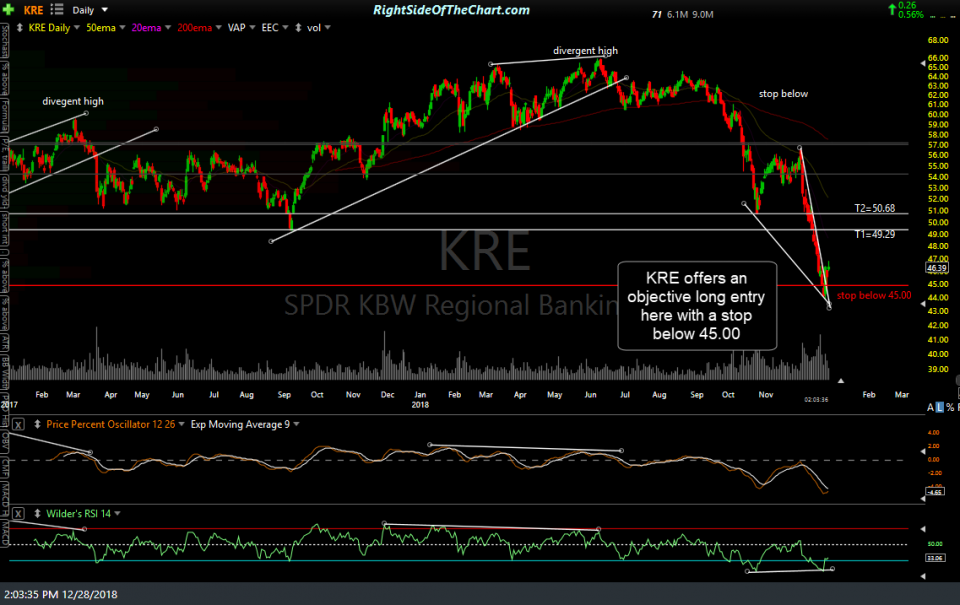

I just returned from vacation & wanted to get at least one official trade idea added before we head into the weekend. KRE (regional bank sector ETF) once again offers an objective long entry here with a stop on any move below 45.00.The price targets for this trade will be T1 at 49.29 & T2 at 50.68 (revised slightly below the final target on the recent KRE trade) with a suggested beta-adjusted position size of 1.0.

As I’ve just returned to my desk, I will reply to questions, comments & charts requests later today & throughout the weekend. Regarding the other two long trades that were stopped out earlier this week (QQQ & IWM), I posted the following in the trading room last night & still think those previous price targets are likely to be hit in the coming weeks:

I’m just getting back from the park now after another long day but wanted to say that while two days doesn’t make a trend, it is certainly a start with the market appearing to have shifted from distribution mode to accumulation with what I think is a fairly high likelihood of additional upside in the coming weeks+.

If things play out as I suspect going forward, trying to short rips may to prove to be difficult over the next week or so. I will be returning from vacation tomorrow afternoon & will post a comprehensive update then.

Although I haven’t had the time to add back any of the recently stopped out long trades back as official trades (IWM, QQQ & KRE), price targets for all three would be the same as the recent trades, which can be referenced via the Completed Trades- Long category under the main menu or by selecting those symbol tags from the drop-down menu near the bottom of the sidebar on the right side of the trading room.